Weekend Update #97

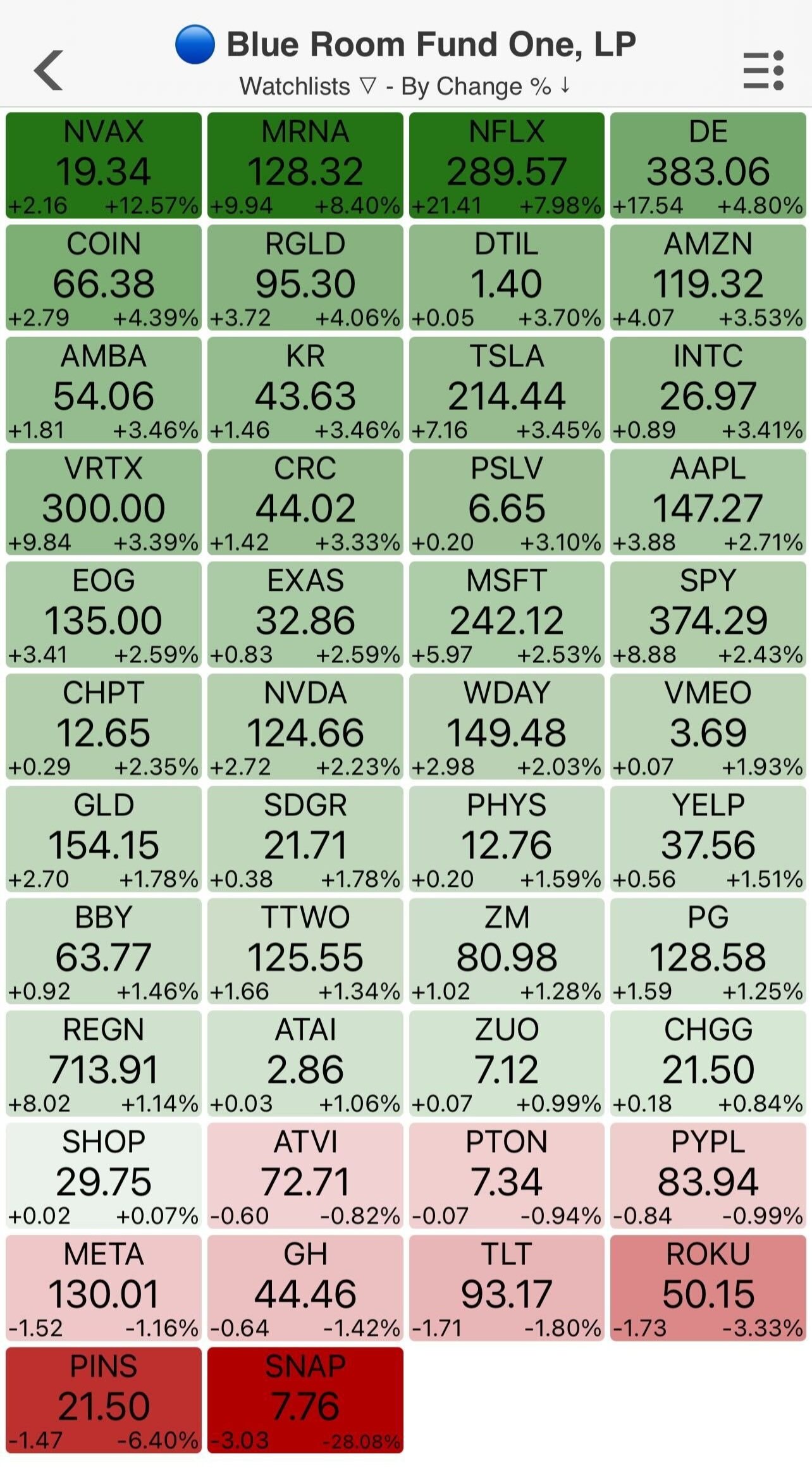

Welcome to Blue Room's Weekend Update. Each week, we're sharing what companies we're researching and the what, the who and the how that we think makes the companies interesting and unique. This roundup is brought to you weekly by a group of interns, creative minds, artists and investors who believe that through best in class investing along with the democratization of financial education we can do great things together. Enjoy, Explore and Share.Earnings season got into full swing this week following the previous Friday’s bank earnings releases. JPMorgan beat third quarter profit estimates on its highest quarterly net interest income ever and raised FY guidance which sent shares up almost 4%. Wells Fargo missed its profit estimates but beat revenue expectations, driven by higher interest rates and loan balances. Morgan Stanley missed Q3 profit and revenue estimates as investment banking revenue collapsed by 55%, sending its shares down 5%. Citigroup reported a 25% decline in Q3 profits on credit loss provisions and poor deal flow but topped revenue expectations on high net interest income, lifting their shares by 2%.

On Monday the pound and UK bonds surged as more of Prime Minster Liz Truss’ unfunded tax cuts were reversed. Tuesday saw earnings from Goldman Sachs and Netflix—the former disclosing a shake-up in its leadership ranks and organizational structure, including a combination of its investment banking and trading divisions into one unit, and asset and wealth management into another, while Netflix reported subscriber growth when everyone expected a loss. Tesla reported on Wednesday and fell short of revenue estimates. On Thursday, social media company Snap reported a revenue miss despite seeing user growth as companies cut back on ad and marketing expenditure, given the tough economic environment.

On the Fed Speak front, the market received mixed messages. Federal Reserve Bank of St. Louis President James Bullard said he expects the central bank to end its “front-loading” of aggressive interest-rate hikes by early next year and shift to keeping policy sufficiently restrictive with small adjustments as inflation cools. Federal Reserve Bank of Philadelphia President Patrick Harker said officials are likely to raise interest rates “well above” 4% this year and hold them at restrictive levels to combat inflation, while leaving the door open to doing more if needed. However, Federal Reserve Bank of Minneapolis President Neel Kashkari said that the US central bank could potentially pause its interest-rate increases at some point next year if policymakers see clear evidence that core inflation is slowing, adding “my best guess right now is yes, do I think inflation is going to level out over the next few months, the services, the core inflation, and then that would position us some time next year to potentially pause.”

Thank you Blue Room Team Leader OMAR GUZMAN.

Earnings Call Highlights

Third quarter revenue increased sequentially 14.8% in New Taiwan dollars, or 11.4% in US dollars, as their third quarter business was supported by strong demand for their industry-leading 5-nanometer technology

Third quarter gross margin increased 1.3 percentage points sequentially to 60.4%, slightly ahead of their guidance, as they enjoyed a more favorable foreign exchange rate and cost improvement efforts

Total operating expenses accounted for 9.8% of net revenue as compared to 10% in the previous quarter

Operating margin increased 1.5 percentage points sequentially to 50.6%, mainly due to operating leverage

Overall, third quarter EPS was NT$10.83, and ROE was 42.9%

Mickey Foster — Vice President of Investor Relations

Good afternoon and welcome to FedEx Corporation’s first quarter earnings conference call. Before we begin, we want to recognize our SEC 8-K was filed earlier than planned due to a technical issue. The first quarter earnings release, Form 10-Q and stat book are on our website at fedex.com. This call is being streamed from our website where the replay will be available for about 1 year.

Joining us on the call today are members of the media. During our question-and-answer session, callers will be limited to one question in order to allow us to accommodate all those who would like to participate. We want to remind all listeners that FedEx Corporation desires to take advantage of the Safe Harbor provisions of the Private Securities Litigation Reform Act. Certain statements in this conference call such as projections regarding future performance may be considered forward-looking statements within the meaning of the Act. Such forward-looking statements are subject to risks, uncertainties and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For additional information on these factors, please refer to our press releases and filings with the SEC. Please refer to the Investor Relations portion of our website at fedex.com for a reconciliation of the non-GAAP financial measures discussed on this call to the most directly comparable GAAP measures.

Business Updates

July 11: Tesla-Hertz partnership expands to sixteen new cities

July 14: Tesla executive overseeing AI and Autopilot is leaving company

July 27: Tesla Insurance expands to Georgia, Utah and Maryland

August 1: Tesla secures battery material supply deals with China’s Huayou and CNGR

August 8: Tesla discloses lobbying effort for new factory in Canada

August 16: Tesla expands its Virtual Power Plant to Southern California

August 18: Tesla announces Semi 500-range model to start shipping this year

August 24: Tesla 3-for-1 stock split closes

August 30: Tesla files to build new battery manufacturing line at Fremont Factory

Sept. 5: Tesla raises Full-Self Driving price to $15,000

Sept. 8: Tesla ramps up hiring for Megafactory, aiming to produce 40 GWh per year

Sept. 12: Tesla requires Powerwall for every solar roof project

Sept. 14: Vote on planned Tesla Berlin expansion delayed indefinitely

Sept. 19: Tesla completes expansion to boost output at Shanghai factory

October 6: S&P Global upgrades Tesla credit rating to BBB from BB+

October 12: Tesla introduces Dynamic Pricing on Superchargers in Europe to reduce congestion and grid load

October 17: Tesla launches home charging station, compatible with other EV brands

Q3 2022 Earnings Expectations (from Bloomberg):

Adjusted EPS: $(0.02)

GAAP EPS: $(0.24)

Revenue: $1.139 billion (+7% year-over-year)

Net Loss: $(391.6) million (compared to $(72.0) million in Q3 2021)

Adjusted EBITDA: $27.5 million (compared to $174.2 million in Q3 2021)

Avg. Revenue Per User (ARPU): $3.18 (-9% year-over-year)

Daily Active Users (DAUs): 359 million (+17% year-over-year)

Q3 2022 Performance:

Adjusted EPS: $0.08

GAAP EPS: $(0.22)

Revenue: $1.128 billion (+6% year-over-year)

Net Loss: $(359.5) million (compared to $(72.0) million in Q3 2021)

Adjusted EBITDA: $72.6 million (compared to $174.2 million in Q3 2021)

Free Cash Flow: $18.1 million

Avg. Revenue Per User (ARPU): $3.11 (-11% year-over-year)

North America: $8.13 (-1% year-over-year)

Europe: $1.83 (-4% year-over-year)

Rest of World: $0.89 (-9% year-over-year)

Daily Active Users (DAUs): 363 million (+19% year-over-year)

Cash, cash equivalents, and marketable securities: $4.4 billion

Business Updates

July 6: Netflix announces ‘Stranger Things’ spin-off as creators form new production company

July 13: Netflix picks Microsoft as partner for ad-supported service

July 18: Netflix tests new paid sharing strategy in five Latin countries

Sept. 12: Netflix partners with Ubisoft to create three mobile games

Sept. 14: Netflix lays off 30 animation employees

October 6: Netflix to Release Knives Out Sequel in Theaters Before Online

October 10: Netflix taps Integral Ad Science and DoubleVerify to help with ad measurement

October 12: Netflix nears deal to build production complex on Jersey Shore

October 13: Netflix announces ad-supported service to launch November 3 at $6.99 per month

October 17: Netflix launches Profile Transfer, allowing users to keep profile when switching to different account

With midterm elections roughly two and a half weeks away, President Biden and the Democratic Party are working overtime to ensure their control over both the executive and legislative branches. The question as to who will win the legislative majority is anything but certain. If history is to be our guide, then we can expect the Democrats to lose seats in both the House and the Senate. In the 22 midterms elections from 1934 to 2018, the President’s party has averaged a loss of 28 House seats and four Senate seats. Indeed, the President’s party gained seats in the Senate only six times, and gained seats in the House only three times. The President’s party has gained seats in both legislative bodies only twice – with Franklin D. Roosevelt in 1934 and then again with George W. Bush in 2002.

Currently, the Democrats have a nine seat margin in the House and the parties are split in the Senate. A Democratic loss in the House of fewer than twelve seats would be very unexpected, but the Senate is still a toss up. However, the Republican Party is experiencing a jolt of momentum brought about by infusions of ad spending and persistent voter anxiety over high inflation. Economic health, after all, remains the most important issue to voters – with 77% of registered voters saying the economy is very important to their vote in the 2022 congressional elections. According to a recent Wall Street Journal analysis, “a Democratic lead of about two percentage points on the generic ballot – the question of whether voters plan to back a Democrat or Republican for Congress – has been cut by more than half since late September…” Further, “Democratic leads in many Senate races have declined, according to aggregated polls, and Democratic candidates now trail in surveys in Wisconsin and Nevada, where they once were ahead.” With little time left to regain momentum, it seems as if President Biden and the Democratic Party are “in the endgame now.”

BLUE ROOM

— TUESDAY OCTOBER 18 4pm EST —

FUND ONE 2022 Q3 EARNINGS REPORT

Please enjoy this deep dive into Fund One Q3 Earnings alongside our macro and micro proprietary research.

To learn more…

10% OF ALL BLUE ROOM REVENUES GO DIRECTLY TO FUND OUR NON PROFIT TOGETHERISM.

WE CAN ACCOMPLISH ANYTHING TOGETHER.

These materials do not purport to be all-inclusive or to contain all the information that a prospective investor may desire in considering an investment. These materials are intended merely for preliminary discussion only and may not be relied upon for making any investment decision. Any discussion or information contained in this presentation does not serve as a receipt of, or as a substitute for, personalized investment advice from Blueroom or your advisor.

This publication does not constitute an offer to sell or a solicitation to buy any securities in any fund, market sector, strategy or any other product. Investing is speculative and involves substantial risks (including, the risk of loss of the investor’s entire investment). Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable.

For more information about us and our general disclosures contact us directly.