Weekend Update #81

Welcome to Blue Room's Weekend Update. Each week, we're sharing what companies we're researching and the what, the who and the how that we think makes the companies interesting and unique. This roundup is brought to you weekly by a group of interns, creative minds, artists and investors who believe that through best in class investing along with the democratization of financial education we can do great things together. Enjoy, Explore and Share.Stocks continued brutal sell-offs leading into the final week of the 1H22 giving way to the worst first half for the S&P 500 index since 1970, falling 20.6%. The Nasdaq and Dow indices have also fallen 29.5% and 15%, respectively. Economic releases are indicating that the economy may be slowing down at an unexpected pace. ISM Manufacturing index data pointed to weaker June activity than expected, with the gauge dropping to its lowest level since June 2020. Conference Board Consumer Confidence fell in June to 98.7, underwhelming expectations of 100.0, highlighting the general concerns regarding inflation and a possible recession. Wholesale inventories increased 2.0% MoM relative to the expectation of 2.1%. It should be noted, however, that the reported measure is adjusted for seasonality, but not for inflation. The inventory conundrum may still be up-in-the-air. Personal Consumption was revised significantly weaker to 1.8% versus the 3.1% surveyed, showing softening demand, specifically 3.7% in non-durables. Core PCE rose 0.3% MoM versus 0.4% expected, while it rose 4.7% YoY versus the 4.8% expected. Foods and energy continues to lead a large portion of the headlining PCE measures.

Nearly all major industries that represent the S&P 500 rose on the final day of trading this week except for the Semiconductors. As we noted in our newsletter last week, the upcoming slew of earnings for the semis will be telling of the current state of the demand cycle. With Micron Technology, Inc. reporting weaker Q4 and 2023 demand in consumer end-markets, the SOXX Semiconductor ETF fell 3.58% on Friday. The ETF measuring the largest publicly traded semiconductor companies is down 38.82% year-to-date.

On a macro level, Russia defaulted on its foreign-currency sovereign debt for the first time in a century, despite having the, “the means, and the will, to pay”. Evidently, Russia has the ruble equivalent of the $100 million in payments, but may not settle the balance due to ongoing financial roadblocks instituted by the major Western governments. Bondholders are currently taking a wait-and-see approach to the current situation for fear of further prodding the Russian government.

MAJOR INDICES - PERFORMANCE THIS WEEK

S&P 500 - Finished down, -3.18%

Nasdaq - Finished down, -3.93%

DJIA - Finished down, -2.47%

Thank you Analyst IAN CARTER.

The personal consumption expenditures index, an inflation gauge closely-watched by the Federal Reserve, increased 0.6% month-over-month in May, representing an accelerating pace compared to the prior month’s 0.2% gain. It was, however, lower than the expected 0.7%.

The index rose to 122.052 in May from 121.339 in April.

HEADWINDS:

Greater China sales channel volatility due to zero-tolerance COVID rules, which impact supply chains for export purposes, especially into the U.S. NIKE CEO and CFO cited higher freight costs only continuing to increase. Concerns about levels of consumer demand in the near-term due to elevated inflation and consumer willingness to spend. Higher levels of business investment as well as a return to normal levels of promotionality versus pandemic levels.

TAILWINDS:

Inflation definitely will be trickled down to the consumer [NIKE indicated that revenue should grow low double digits on currency neutral basis, but real dollar revenue will be flat to slightly up]. For now, demand seems to be elevated, so slower growth may not be as large of a concern, this is TBD. Business investment now targeting women with new innovations being marketed specifically for the women’s channel. NIKE has supreme brand equity with men and teens, now seeking to build the same with women’s category and sponsoring women’s sporting events, etc. Far more cautious about inventory now and will take a ‘seasonless’ apparel approach to inventory stacking just in case.

On Tuesday, June 28th, The Conference Board released its Consumer Confidence survey data for the month of June.

The index reading came in at 98.7, below the consensus estimate of 100.0 — reaching the lowest reading since February 2021. The main diver of falling confidence in June was the deterioration in expectations on the economy’s 6-month future outlook.

Both Consumer Confidence and Consumer Sentiment readings have fallen since June 2021, and both surveys point to further deteriorating confidence and sentiment among consumers due to persistently high inflation eroding their purchasing power and dampening outlooks on the economy’s near-term prospects.

Looking at the confidence survey’s historical correlations, past recessions have been preceded by at least a 10-point drop in consumer confidence. The June reading marks over a 30-point drop since the 128.9 peak in June 2021.

The United States is currently facing an increasing amount of discourse about the rising probability of a recession in the next 2 years, persistently high price increases in a broad number of industries, and the Federal Reserve using interest rate hikes to attempt to slow demand throughout the country while still achieving a “soft landing”. Although, in recent days, Fed Chair Jerome Powell has more specifically started referencing the risk of recession as a result of the Federal Reserve’s actions.

The cryptocurrency market continued to slide in June, dipping below the $1 trillion mark, its lowest point since January 2021, as a slew of bleak economic data for the month of May further worsened the outlook for the macroenvironment. The consumer price index (CPI) for May came in above estimates, setting another 40-year record high, at 1.0% month-over-month and 8.6% year-over-year. University of Michigan’s Consumer Sentiment Index also fell to a record low 50.2 in June, worse than even the Great Financial Crisis and the 1980s inflationary period — as respondents cited worsening impacts of inflation and worsening financial outlooks. Similarly, the NFIB Small Business Optimism Index came in at 93.1, continuing its fifth consecutive week below its 48-year average of 98 while also reaching record lows for business expectations and citing inflation and quality of labor as the single most important problems. Initial jobless claims reached 231,000 last week, continuing its upward trajectory since hitting a bottom in March as many companies began announcing layoffs and hiring freezes. In response to the economic data, the Fed turned more hawkish and announced a 75 basis point rate hike which further contributed to the risk-off sentiment. Similar to gold, the strength in the US Dollar as a result of rate hikes has also contributed to lower prices for digital assets such as Bitcoin. As the possibility of a recession — which would be a first since Bitcoin’s inception — becomes increasingly likely, crypto will face the ultimate test as broader economic trends risk dragging the crypto market down even further.

HEADWINDS:

Although Micron delivered on guidance and beat consensus estimates on the top line, the FY22 outlook raised concerns about client-side demand. Consumer demand and inventory headwinds are posing challenges for the Q4 outlook, implying slower revenue growth on a comparable year-on-year basis. Micron guidance calls for revenue at $7.2 billion at the midpoint with a wider error margin than was provided in the previous quarter, further indicative of demand uncertainty. GAAP Q4 operating margin is projected to come in at around 26.0%, which is lower than the +30.0% long-run target the company set for itself earlier this year.

TAILWINDS:

Despite much weaker demand in the consumer markets, the outlook for longer term targets remains strong on the backs of AI and ML trends, most promisingly in hyperscaler, enterprise and automotive end-markets. The company affirmed its market leadership in both DRAM and NAND technology against the macro backdrop, which satisfies concerns over market share. The developing 176-layer node reached majority of sales in 2022, and has persisted through, indicating strong product leadership in the NAND segment. The 55-to-45 percent revenue split in favor of mature mobile PC and consumer markets is expected to ship to 38-to-62 percent in favor of higher growth data center, automotive, industrial, networking and graphics markets. These markets may offer more profit stability and accelerate overall growth once consumer end markets bounce back.

PLEASE ENJOY THESE COMPANY UPDATES FROM OUR BRILLIANT TEAM OF INTERNS

JACKSON BLAUFELD

Ticker: KR

Name: The Kroger Company

Shares Outstanding: 720M

Market Capitalization: 34.88B

Stock Price History:

June 30, 2022: $47.83

June 29, 2022: $48.11

June 28, 2022: $48.43

June 27, 2022: $48.70

June 24, 2022: $48.45

June 23, 2022: $47.73

June 22, 2022: $47.34

June 21, 2022: $48.40

June 17, 2022: $46.20

June 16, 2022: $49.82

June 15, 2022: $50.88

The Kroger Company was founded in 1883 and is based in Cincinnati, Ohio. Kroger operates as a retailer in the United States and is consistently one of the largest retailers domestically based on sales. As of the beginning of this calendar year, Kroger operates 2,726 supermarkets under various banner names in 35 states and the District of Columbia, and has around 420,000 full-time employees. Kroger’s retail business is built on a strong foundation of the Company’s market leading position in food retail, reflecting the strength of its seamless shopping experience, Our Brands products, and unique combination of assets. Kroger is evolving from a traditional food retailer into a more diverse, food first business made possible by traffic and data generated by the retail supermarket business.

In the past few years, Kroger has taken steps to adjust its business model in response to ever-changing consumer behaviors.

In 2017, Kroger announced its “Restock Kroger” initiative which, in hindsight, was ahead of its time. The purpose of this program was to “feed the human spirit” through “serving America through food inspiration and uplift.” Kroger allocated a large amount of resources towards technology and store-brand products.

One of the main pillars of this project was to redefine the customer experience when it comes to grocery shopping. Kroger was able to analyze 60 million households while providing 500 billion personalized recommendations based on data which has allowed Kroger’s seamless shopping experience to take off in recent years. This was most evident during the pandemic when customers were eager to order groceries and other essential products online. Kroger’s digital sales grew by 116% in 2020, made possible in large part due to its preparedness when it came to digital shopping.

Additionally, Kroger also allocated resources to its Our Brands products which provide highest-quality options for customers at a fair price. In the latest fiscal year, Our Brands products represented nearly $28 billion of the Company’s sales. Currently, as consumers are navigating the inflationary environment, customers are increasingly buying more store brand items to stretch their grocery dollar. Most recently, Kroger launched 239 new Our Brands products with a focus on summer cooking.

Lastly, one of Kroger’s many partnerships is with Ocado, a market leader in supply chain efficiency. Together, Kroger and Ocado have introduced America’s first customer fulfillment center driven by robotics. Since then, this partnership has produced many after sales in cities across the country, most recently announcing plans to open another warehouse in the Denver metropolitan area.

These key initiatives have allowed Kroger to have success throughout the COVID-19 pandemic, and today in the current inflationary environment in a crowded and highly competitive industry.

LUCA FAGOTTI

Ticker: TWLO

Name: Twilio, Inc.

Number of Shares Outstanding: 171.86M

Market Capitalization: $ 16.28B

Stock Price History:

June 15, 2022: $83.25

June 16, 2022: $81.90

June 17, 2022: $79.01

June 21, 2022: $85.10

June 22, 2022: $83.72

June 23, 2022: $89.00

June 24, 2022: $98.65

June 27, 2022: $99.12

June 28, 2022: $97.00

June 29, 2022: $91.23

Twilio, Inc. Executive Summary (6/29/22)

Twilio, Inc. is a customer engagement platform based in San Francisco that operates in all communication channels (voice, text, chat, video, and email) through its diverse set of APIs. Twilio’s API portfolio includes MessageX which sends and receives SMS, MMS and on platforms like WhatsApp and Facebook Messenger, providing services like delivery notifications, Twilio Programmable Voice which makes and receive phone calls globally and offers services like text-to-speech, conferencing, recording and transcription, Twilio SendGrid Email which solves email delivery challenges and provides sender authentication, security, and mobile support, Programmable Video which adds voice and video functionality to the web and mobile applications, Twilio Live which creates interactive livestream experiences through chat and polls, and Twilio Conversations API which facilitates group interactions for customer support and commerce use cases.

Since 2019, Twilio has conducted a series of strategic acquisitions to grow and improve its product offerings. Twilio’s acquisition of SendGrid in February 2019 allowed it to add a leading e-mail API platform to its product offerings. Additionally, in November 2020, Twilio acquired Segment, the market-leading customer data platform which empowers businesses to collect first-party customer data in real time so that developers and companies can create more personalized and impactful engagement. Shortly after marrying Segment’s customer data platform with its global engagement capabilities, Twilio was named the #1 Customer Data Platform (CDP) for worldwide market share in 2021 by IDC. In March 2021, Twilio acquired India’s communication platform ValueFirst to broaden its messaging capabilities and further penetrate the Indian market. Several months afterwards, Twilio acquired Zipwhip to offer developers and businesses another affordable and high-quality engagement option via messaging-enabled toll-free numbers. Twilio’s sustained competitive differentiation suggests that it will be able to defend its market share going forward. With regards to competition, Azure and Amazon remain threats as improved functionality or decreased costs could weigh in on Twilio’s future. Other low-cost competing products worth mentioning are Vonage, Messagebird and Plivo.

Looking further into 2022, the looming macro-economic landscape (inflation, labor shortages, rising interest rates, etc.) might not pose a significant risk to Twilio’s operations given that the company’s core function of enabling communication is too vital to be cut. Furthermore, economic hardship often results in increased messaging. Twilio also stands to gain from the transition from third-party data to first-party data which has been triggered by the changing regulatory landscape and consumer preferences. This shift poses an immense risk to developers and businesses without first-party data ecosystems as they stand to lose their customers without personalized and impactful engagement. According to Twilio’s State of Personalization Report (published on June 21, 2022), “62% of consumers expect personalization, saying that a brand will lose their loyalty if their experience is not personalized — meanwhile, 49% will become repeat buyers if personalization is offered.” Most consumers, however, want personalization so long as brands use their own data and not data purchased or rented from third parties. Twilio’s recent acquisition of Segment will allow its Customer Engagement Platform (CEP) to greatly benefit from the transition to first-party data.

RYAN JOHNSON

Ticker: V

Name: Visa Inc.

Shares Outstanding: 1.645M

Market Capitalization: $421.19B

Stock Price History:

June 27, 2022 $203.62

June 24, 2022 $205.51

June 23, 2022 $196.64

June 22, 2022 $193.82

June 21, 2022 $194.39

June 17, 2022 $190.01

June 16, 2022 $189.05

June 15, 2022 $196.16

Visa Inc. operates as a payments technology company throughout the world that facilitates digital payments among consumers, merchants, financial institutions, businesses, strategic partners, and government entities. The company acts as a middleman between its clients and allows an easier way to make digital payments, with some of their primary revenue streams including service revenues, data processing revenues and international transaction revenues. Among these revenues, YoY growth slowed down during the pandemic as discretionary spending became more difficult with a multitude of quarantine and movement restrictions. Since these restrictions have become more lenient, the revenue streams have rebounded from 2020-2021 and into 2022 through Q1 and Q2.

Although revenue, and subsequently net income, have rebounded from dips during the pandemic, Visa Inc. still has an array of risk factors they have to account for. Among these risks are regulatory risks and government imposed restrictions, personal data and information laws, litigation risks, and technology and cybersecurity risks. Within different jurisdictions there may be different regulations imposed on digital payment platforms, such as fees or limits to accessibility. In China, for example, they prefer a domestic digital payments company called UnionPay, preventing United States or other international payments companies from entering the expanding market there. In regards to the aforementioned risks, policy can impact what information can or cannot be kept, and infringements on these policies can lead to class action lawsuits or fines. Technological and cybersecurity risks include breaches in defense mechanisms Visa has in place against hackers or those with malintention, and can lead to personal information or financial information being stolen or made easily accessible.

Another potential risk includes the adoption of the “buy now, pay later” model, where consumers can make installments of payments over a period of time. Consumer creditworthiness is often overlooked when offering buy now, pay later payment options, the result being consumers unable to make their installment payments. Industry executives have mixed opinions on buy now, pay later, and as it becomes more prevalent in the digital payments industry there could be both positive or negative ramifications for a middleman like Visa.

In more recent news, Visa Inc. announced that James Hoffmeister, Senior Vice President, Global Corporate Controller and Chief Accounting Officer, tendered his resignation, effective July 1, 2022. Hoffmeister will transition to the role of Chief Financial Officer of Visa Europe Limited on July 1, 2022. Peter Andreski will fill Hoffmeister's shoes, and was appointed as Senior Vice President, Global Corporate Controller and Chief Accounting Officer, effective July 1, 2022. Prior to his appointment, Andreski served as Senior Vice President and Global Head of Revenue Operations since June, 2019.

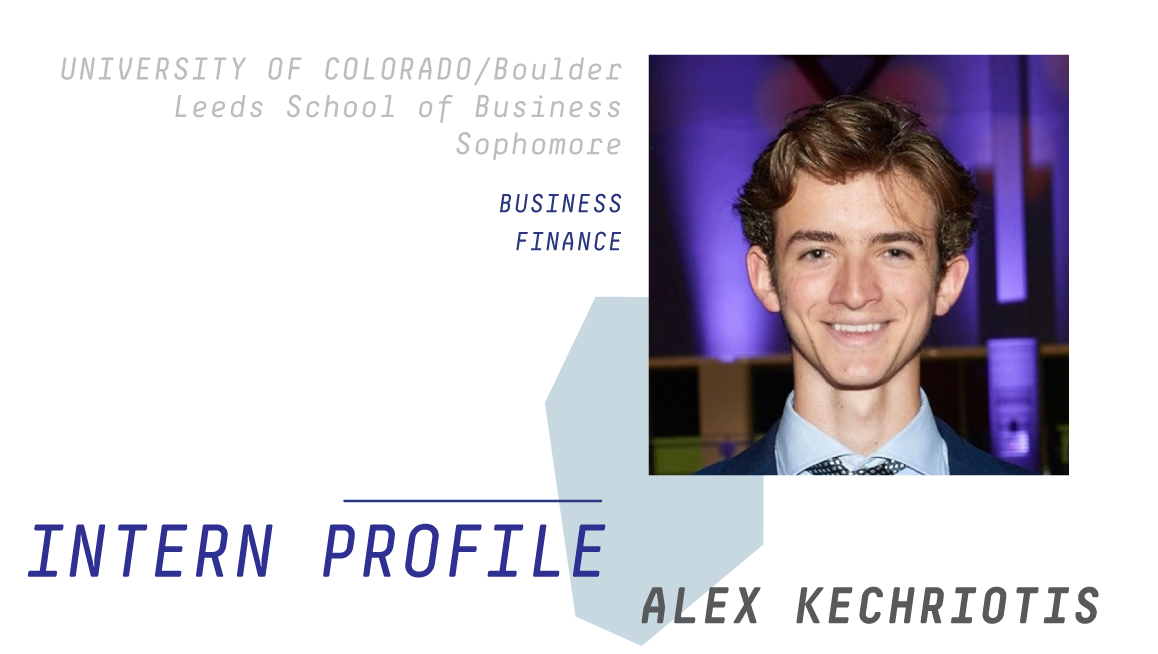

ALEX KECHRIOTIS

Ticker: NTR

Name: Nutrien Ltd.

Shares Outstanding: 551.3M

Market Capitalization: $46.59B

Stock Price History:

June 29: $82.63

June 28: $84.62

June 27: $83.68

June 24: $80.19

June 23: $78.95

June 22: $86.28

June 21: $86.29

June 17: $83.04

June 16: $85.23

June 15: $87.98

Nutrien Ltd. Executive Summary

Nutrien is a Canadian fertilizer and agricultural inputs company, headquartered in Saskatoon, Saskatchewan. Nutrien is a new company, founded in 2018, from the merger of two well-established Canadian fertilizer companies: Agrium (est. 1931) and PotashCorp (est. 1975). It is the largest fertilizer company in the world, with a market capitalization of $46.59B. It produces all three major fertilizers: nitrogen, phosphorus, and potassium, and operates a retail business that distributes equipment, fertilizer, and crop protection chemicals via 2000+ stores across the world. Nutrien’s strategy focuses on reducing production costs in existing operations before chasing volume. They have a steady revenue stream through their retail segment, but can turn profits on potash and ammonia even when prices are below the marginal cost of production. Their revenues typically follow the crop cycle, with a significant jump in revenue coming in the second quarter of a given year, following the planting of summer and fall crops. The past two quarters have seen tremendous growth in revenue due to increases in fertilizer prices following the supply shocks from the Russia-Ukraine conflict.

In the past month, Nutrien has announced its plans to build the world’s largest clean ammonia plant at a site in Geismar, Louisiana that will produce upwards of 1.2 million tons of clean ammonia annually. They also announced their plans to ramp up production of potash by 18 million tons per year, over the next 5 years, in response to supply being limited by the Russia-Ukraine conflict. To do this, they will be hiring 350 new employees and making expansions to their existing potash mining operations.

Fertilizer as a whole has increased dramatically in price over the last year, however not due to Covid-19-related supply issues, but rather due to sanctions imposed on Belarus and Russia, which together produce around 30% of the world’s potash and 15% of the world’s phosphorus. We should expect continued fertilizer shortages for the following years, but prices will fall back to cyclical levels as these sanctions are lifted. The fertilizer industry as a whole surpassed $190 billion as of 2020, with a projected CAGR of 3.8% from 2022 to 2027. In my opinion: the growing population, dietary improvements among developed and developing nations, and decreasing arable land and freshwater will continue to increase our reliance on fertilizers to improve crop efficiency in the following decades.

NITESH PANT

Ticker: CHPT

Name: Chargepoint

Shares Outstanding: 335.94M

Market Capitalization: $4.6 Billion

Stock Price History:

June 28, 2022 $13.86

June 28, 2022 $14.40

June 27, 2022 $15.39

June 24, 2022 $15.46

June 23, 2022 $15.5

June 22, 2022 $14.25

June 21, 2022 $14.43

June 17, 2022 $14.03

June 16, 2022 $12.55

June 15, 2022 $13.66

Chargepoint Executive Summary

ChargePoint Holdings, Inc is a leading electric vehicle charging technology solutions provider and is creating a new fueling network to move people and goods on electricity. Chargepoint provides networked charging solutions in North America and Europe for all segments-commercial, fleet and residential. Chargepoint has activated approximately 174,000 ports on its network, including approximately 11,500 DC ports. ChargePoint sells networked charging hardware, cloud- based software services and extended parts and labor warranty solutions to customers to enable electrification. ChargePoint does not sell networked charging hardware without its software. In addition, ChargePoint rarely owns EV charging assets nor does it try to profit from electricity or driver charging fees. ChargePoint believes its operating model allows it to scale active network ports more cost efficiently as compared to other models in the EV industry, where the charging station provider owns and operates the unit, and it gives the site owner or operator full control over branding, access, pricing and policies in an effort to ensure a positive driver experience. Recent BWG call summaries have noted that this model of owning and operating will probably be the leading model in the future. ChargePoint estimates it had approximately a 70% market share in publicly available networked Level 2 AC charging in North America as of January 31, 2022. Furthermore, Chargepoint believes that its subscription model will yield potential for recurring revenue.

Despite these impressive growth models, Chargepoint is yet to make profits and doesn’t expect to do so for the next few years. That being said, the EV charging market is bound to explode as EV sales continue to go up. BENF estimates that demand for EV charging infrastructure will grow to between 113 and 128 million connectors by 2020, and between 339 million and 490 million connectors by 2040. Home chargers will dominate the market and will make up 88% of all infrastructure by 2040. However, public fast chargers and e-bus and truck chargers deliver over 50% of the total energy demand in 2040 despite only representing only 3% of all chargers. Larger growth expected from 2030 onwards in the number of charging ports. Private connectors will lead the market while public charging will only account for 5-7%. Europe will lead America in sheer number of chargers, but both will be outdone by China.

Chargepoint maintains a strong lead in the North American market, and is hoping to succeed in the European market as well. Currently, Chargepoint has no indicated plans to enter the Chinese market, which is expected to be the biggest EV market. Thus, it remains to be seen how much market share Chargepoint can capture in the European and North American markets. Scalability remains an issue and it is yet to be seen how Chargepoint can deliver on capturing these markets. Furthermore, different regulatory environments in Europe will present difficulties for Chargepoint to expand. Chargepoint also faces competition from Blink and WallBox (a company based in Europe). In addition to these, the biggest competition comes from Tesla’s Supercharger network. This vast network of fast chargers gives Tesla owners little incentive to opt for ChargePoint. That being said, Chargepoint is the leader in Level 2 AC charging technology provider, and if it can maintain this lead, Chargepoint has potential to grow as the EV market grows.

Hello Blue Room Newsletter readers! My name is Alex Kechriotis and I am a rising sophomore at the Leeds School of Business at CU Boulder. There, I am majoring in financial management and, this next school year, I’m looking to pursue a minor in chemistry with an emphasis in pharmaceutical chemistry. I am a member of the Leeds Investment and Trading Group, which covers all aspects of trading and economics. They invite local funds and investment groups to speak every week and I’d love to see Blue Room give a presentation there some time! I’ve grown up and currently live in the city of Denver, Colorado, which is great due to its proximity to my school and to the Blue Room HQ, which I have been interning at since the start of May. After spending four years in New Hampshire, at Phillips Exeter, for highschool, I’m glad to be back enjoying the natural amenities that Colorado has to offer.

At Blue Room, I began my internship by indexing all of Blue Room’s newsletters and, in doing so, got caught up quickly on two years worth of Blue Room lore, company culture, and some great examples of past intern’s work. Since then I have been joined by five, very talented interns who have each been covering a company in collaboration with the investment team. I cover Nutrien (NTR), an agricultural inputs and fertilizer company out of Saskatoon, Canada with some very promising expansions planned in the next few years. Blue Room’s holistic view of investing and economics, incorporation of creative expression throughout the office and in their work, and great respect given to each individual at the company have all stood out so much to me in my time here. Blue Room Housing and Dry Storage provide an awesome diversification to Blue Room’s operations that make it so much more than just a hedge fund. I love to hear updates on these projects each week during our Global Meetings.

In my free time I enjoy playing pick-up basketball, drawing, and reading as much as I can about economics, trading, art, and philosophy.

F

U

N

D

O

N

E

IS LIVE

10% OF ALL BLUE ROOM REVENUES GO DIRECTLY TO FUND OUR NON PROFIT TOGETHERISM.

WE CAN ACCOMPLISH ANYTHING TOGETHER.

These materials do not purport to be all-inclusive or to contain all the information that a prospective investor may desire in considering an investment. These materials are intended merely for preliminary discussion only and may not be relied upon for making any investment decision. Any discussion or information contained in this presentation does not serve as a receipt of, or as a substitute for, personalized investment advice from Blueroom or your advisor.

This publication does not constitute an offer to sell or a solicitation to buy any securities in any fund, market sector, strategy or any other product. Investing is speculative and involves substantial risks (including, the risk of loss of the investor’s entire investment). Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable.

For more information about us and our general disclosures contact us directly.