Weekend Update #061

Welcome to Blue Room's Weekend Update. Each week, we're sharing what companies we're researching and the what, the who and the how that we think makes the companies interesting and unique. This roundup is brought to you weekly by a group of interns, creative minds, artists and investors who believe that through best in class investing along with the democratization of financial education we can do great things together. Enjoy, Explore and Share.Major indices demonstrated mixed performances this week. The S&P 500 is poised to close the week down approximately 20 basis points, settling at 4,492.50 while the Dow Jones Industrial Average is on track to close up 24 basis points, settling at 35,165. The Nasdaq Composite Index, meanwhile, is down 30 basis points, settling around 14,050.A slew of economic news came out this week, beginning with NFIB Small Business Optimism, which registered at 97.1 in January, below consensus estimates of 97.5. The U.S. Trade Balance registered a deficit increase of 80.7 billion, one of its largest on record. Government stimulus and a stronger dollar were contributors to increased demand for imports.From a wholesaler perspective, inventories saw a month-over-month increase of 2.2% while trade sales saw a tepid 0.2% increase for the month of January, missing expectations of 1.5%. The inventory/sales ratio saw increases in autos, furniture, and lumber, among others, pointing to a potential inventory recession as demand for goods softens as prices continue to increase.The labor picture seems to have improved somewhat, with initial jobless claims registering at 223,000, below an expected 230,000, while continuing claims came in at 1,621,000—6,000 higher than the expected 1,615,000 figure.The economic story of the week was the latest CPI reading. Headline CPI year-over-year registered at 7.5%—higher than the consensus 7.3%, and the highest reading we’ve had since February 1982. Core CPI (ex. food and energy) came in at 6.0%—higher than the consensus 5.9%. On the food front, beef products saw the largest increases year-over-year—a 16% YoY average, while energy items saw a 33% YoY increase as crude oil supplies held steady while increasing economic activity fueled energy demand. Furniture, used cars and trucks, and lodging away from home comprised the largest YoY increases in the All Items Less Food and Energy category— 17%, 41% and 22%, respectively. Real average hourly and weekly earnings year-over-year data was also released, registering respective year-over-year decreases of 1.7% and 3.1%. Nominal average hourly earnings saw an annual increase of 5.7% but the 7.5% increase in CPI translated into a loss in real average hourly earnings, which also points to softening consumer demand. This is seemingly punctuated by the latest University of Michigan Consumer Sentiment Index reading of 61.7 versus an expected 67.0, indicating a continuing decline in attitudes and expectations regarding personal finances, and general business and market conditions and prices. On the earnings front, several companies reported this week, including Vimeo, Disney, Peloton and iRobot, which you can learn more about further in this week’s newsletter.

Thank you Blue Room Team Leader OMAR GUZMAN

BR Debrief

The consumer robotics company iRobot reported their financial results Wednesday, February 9, and hosted an earnings call on the morning of Thursday, February 10. The company missed revenue estimates for both Q4 and FY 2021, citing semiconductor chip constraints and shipping delays as factors that prevented them from fulfilling $35 million in fourth quarter orders.

The company expects further headwinds on this front through the first half of 2022, but then also anticipates an easing of said headwinds in the second half of 2022, paving the way for top line growth and gross and operating margin expansion in 2023 and 2024.

iRobot also gave further clarity around their newly-acquired Aeris air purification line, stating that they will be rebranding the portfolio in the second half of 2022 and will soon thereafter introduce at least one new air purifier along with integration of Genius-related capabilities across the product line.

While e-commerce declined 9% quarter-over-quarter in Q4 2021, this was offset by 70% growth in the Direct-to-Consumer (DTC) channel. The company expects this trend to continue as the company implements its “GROW” initiative, moving their entire marketing technology stack into production. This is designed to enable personalized digital marketing at scale to deliver the right promotions to the right customers at the right times, which will improve conversion rates and significantly improve DTC’s contribution to overall revenue.

The company remained very optimistic about its prospects, reiterating the long-term financial model projections for 2024 they provided in the 2021 Investor Day that included a revenue range of $2.4 to $2.6 billion, gross margin in the low-40% range, operating profit margin between 12% and 13%, and EPS expanding between $7.50 and $9.25.

On Tuesday, February 8th, Nvidia disclosed the termination of its Share Purchase Agreement with Softbank for Arm, Ltd., a U.K.-based company valued at $40bn. The company stated that this was primarily due to regulatory pushback from the FTC and the European Commission’s committee that oversees mergers concerning European-based companies. The regulators’ primary concern was that the deal could lead to anti-competitive practices that would enable Nvidia to restrict access to Arm’s technology and lead to higher prices, less choice, and reduced innovation in the industry. Other parties concerned with the merger included Chinese regulators and Nvidia competitors like Qualcomm, Intel, Apple, Microsoft, Alphabet and Amazon.

Ticker: DIS

Market Capitalization: $280 billion

Shares Outstanding: 1,828,000,000

Share Price History

January 31, 2022 $142.97

February 1, 2022 $144.49

February 2, 2022 $142.62

February 3, 2022 $140.03

February 4, 2022 $142.02

February 7, 2022 $142.51

February 8, 2022 $142.48

February 9, 2022 $147.23

February 10, 2022 $152.16 ← +3.3% following release of Q1 ‘22 Financial Results

February 11, 2022 $149.47

Q1 2022 Consensus Estimates via Bloomberg:

2022 Q1 Revenue Estimate: $20.86 billion

Media Entertainment Revenue: $14.59 billion

Parks, Experiences, and Product Revenue: $6.13 billion

Adjusted EPS: $0.60 per share

Net Disney+ Subscriber additions: 7.0 million

Total Disney+ Memberships: 125.1 million

Q1 2022 Blue Room Estimates:

2022 Q1 Revenue Estimate: $20.75 billion (27% Y/Y increase)

Media Entertainment Revenue: $14.61 billion

Parks, Experiences, and Product Revenue: $6.13 billion

Adjusted EPS: $0.73 per share

Net Disney+ Subscriber additions: 6.0 million

Total Disney+ Memberships: 124.1 million

Actual Q1 2022 Earnings:

Revenue: $21.82 billion (34% increase Y/Y, beat expectations)

Media Entertainment Revenue: $14.59 billion

Parks, Experiences, and Product Revenue: $7.23 billion

Net Income: $1.15 billion

Adjusted EPS: $1.06 per share

Net Disney+ Subscriber additions: 11.7 million

Total Disney+ Memberships: 129.8 million (37% increase Y/Y, beat expectations)

Corporate Profile:

Vimeo is the world’s leading all-in-one video software solution, providing the full breadth of video tools through a software-as-a-service model. Vimeo’s comprehensive and cloud-based tools empower its users to create, collaborate and communicate with video on a single, turnkey platform. Our platform enables any professional, team, and organization to unlock the power of video to create, collaborate and communicate. We proudly serve our growing community of over 200 million users — from creatives to entrepreneurs to the world’s largest companies. The company offers professional video hosting solutions for small businesses. It provides solutions for creative professionals, small businesses, enterprises, education sector, fitness centers, and faith teams. The company was founded in 2004 and is based in New York, New York.

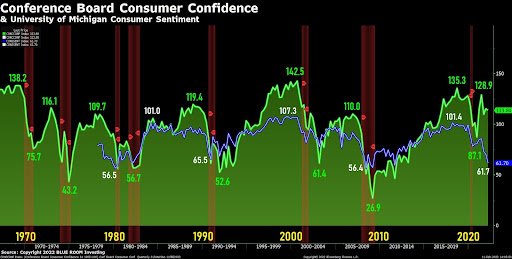

On Friday, February 11th, the Consumer Sentiment index from the University of Michigan fell to 61.7 — the lowest index reading since October 2011. This decline “signals the onset of a sustained downturn in consumer spending.”

The survey cited weakening financial prospects as the driving factor behind this drop. Concerns over inflation, the government’s handling of economic policies, and poor long term economic outlook have become increasingly ingrained in consumers’ expectations and perceptions of current economic conditions. Without a doubt, Americans are feeling the increases in prices, and households with incomes above $100,000 accounted for the largest drop in sentiment in February.

A four decade high, since May 1980: 26% of those surveyed expect their financial conditions to worsen over the next 12 months.

While Consumer Confidence can give us a good sense of labor market indicators, Consumer Sentiment is good at predicting consumer spending based on sentiment.

47% of those surveyed believed that increases in prices would outpace their wage growth over the next 1-2 years. A staggering 64% of Americans believe the country will experience continuously bad economic times over the next 12 months — the weakest outlook in a decade.

63% of consumers expect gas prices to rise, and the majority agrees it is a bad time to buy major household items, vehicles, and houses.

Democrats’ current conditions and future expectations readings continue to fall from October 2021 readings of 87.2 and 95.6, respectively, to 82.2 and 80.2 in February. At the same time, Republican current conditions reports and expectations have slightly increased from lows of 48.7 and 30.7, respectively, in November 2021.

Following months of downward pressure on the stock and multiple leaked reports about Peloton’s internal struggles, Chief Executive Officer John Foley’s remarks in the Q2 2022 earnings call struck a notably refreshing and honest tone.

“We also acknowledge that we have made missteps along the way. To meet market demand, we scaled our operations too rapidly, and we overinvested in certain areas of our business. We own this. I own this, and we are holding ourselves accountable. That starts today.”

— John Foley, Q2 2022 Earnings Call

On January 23, 2022, Blackwells Capital issued a public call for John Foley’s resignation as CEO after a string of poor management decisions and proposed the company market itself to potential acquirers. The activist investor’s call was heard as Peloton announced on February 8th that Foley would transition to Executive Chair with the appointment of Barry McCarthy as the new Chief Executive Officer and President of Peloton.

Barry McCarthy served as Chief Financial Officer of Netflix from 1999-2010 and as the CFO of Spotify from 2015-2019. Under McCarthy’s leadership, Peloton can hit the reset button and look towards engineering “the great comeback story of the post-Covid era.”

“He’s not only recognized as an expert in running subscription business models and helping category-leading digital streaming companies flourish, but he has also had tremendous success in partnering with founder CEOs at other brands. I’m excited to learn from him and work alongside him as Executive Chair.”

— John Foley, February 8, 2022 Press Release

Along with the news of a new CEO, Peloton announced a restructuring program to reduce costs and drive growth, profitability, and free cash flow. The series of changes are expected to result in $800 million in annual run rate savings for the company. Although, consolidation and shifting manufacturing to third-party providers does have consequences.

Rumors that Peloton would delay the opening of its first North American manufacturing facility in Troy Township, Ohio materialized as the company announced they will wind down the factory’s development and seek a sale of the building by 2023. With that decision, Peloton abandons the 2,000 jobs the Peloton Output Park would have created in Ohio.

The most publicly scrutinized part of the restructuring plan was the reduction of 2,800 global positions across all areas of business operations. After failing to grow demand in the back end of the pandemic with price cuts and marketing, Peloton was forced to cut costs and scale back on the investments it had made throughout the pandemic.

“In late September, it became clear to us that the education industry is experiencing a slowdown that we believe is temporary. This industry-wide dynamic was unanticipated and is a direct result of the COVID-19 pandemic, a combination of variants, increased employment opportunities and compensation, along with fatigue, have all led to significantly fewer enrollments than expected this semester. And those students who have enrolled are taking fewer and less rigorous classes and are receiving less graded assignments. We believe this is a post-pandemic impact that will affect this school year but is not sustainable for higher education long-term. Learning sites and apps, both free and paid in the U.S. and Canada, have experienced significantly reduced traffic since the fall semester began.”

- Dan Rosensweig, Chegg Chief Executive Officer

Share Price History (2021: October 28 - November 5)

October 28, 2021 $58.09

October 29, 2021 $59.44

November 1, 2021 $62.76

November 2, 2021 $32.12 -48.82% after Q3 2021 Earnings Release

November 3, 2021 $34.08

November 4, 2021 $31.63

Q4 2021 Highlights:

Total Net Revenues of $207.5 million, an increase of 1% year-over-year

Chegg Services Revenues grew 6% year-over-year to $187.2 million, or 90% of total net revenues, compared to 86% in Q4 2020

Net Income was $24.3 million

Adjusted EBITDA was $78.0 million

4.6 million: number of Chegg Services subscribers, an increase of 5% year-over-year

Full Year 2021 Highlights:

Total Net Revenues of $776.3 million, an increase of 20% year-over-year

Chegg Services Revenues grew 29% year-over-year to $669.9 million, or 86% of total net revenues, compared to 81% in 2020

Net Loss was $1.5 million

Adjusted EBITDA was $265.9 million

7.8 million: number of Chegg Services subscribers, an increase of 18% year-over-year

2022 Guidance:

Total Net Revenues in the range of $830 million to $850 million (6.92% - 9.5% YoY increase)

Chegg Services Revenues in the range of $770 million to $790 million (14.95% - 17.94% YoY increase)

Gross Margin between 70% and 72% (up from 67.16% for the year 2021)

Adjusted EBITDA in the range of $260 million to $270 million

Capital Expenditures in the range of $110 million to $120 million

Free Cash Flow in the range of 50% to 60% of Adjusted EBITDA

A

R

T

Dyani White Hawk: Speaking to Relatives

-and-

Eamon Ore-Giron: Competing With Lightning/Rivalizando con el Relámpago

Join MCA Denver on Wednesday, February 16 to celebrate the opening of two new exhibitions: Dyani White Hawk: Speaking to Relatives and Eamon Ore-Giron: Competing With Lightning/Rivalizando con el Relámpago. The exhibitions feature new and recent works by the artists that recontextualize abstraction within a more expansive legacy of artistic creativity in the Americas. Learn more about these exhibitions here.

I

N

Q

U

I

R

E

10% OF ALL BLUE ROOM REVENUES GO DIRECTLY TO FUND OUR NON PROFIT TOGETHERISM.

WE CAN ACCOMPLISH ANYTHING TOGETHER.