Weekend Update #054

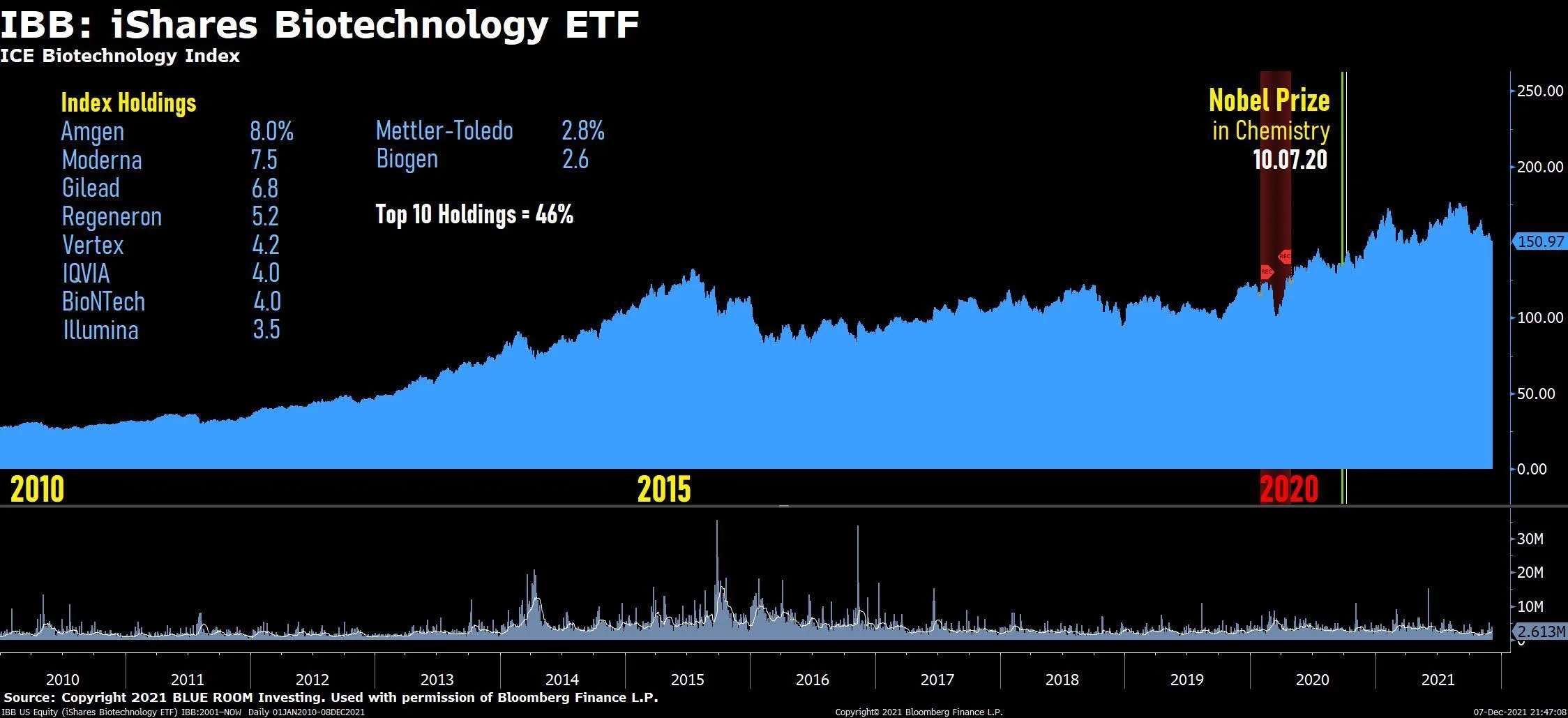

Welcome to Blue Room's Weekend Update. Each week, we're sharing what companies we're researching and the what, the who and the how that we think makes the companies interesting and unique. This roundup is brought to you weekly by a group of interns, creative minds, artists and investors who believe that through best in class investing along with the democratization of financial education we can do great things together. Enjoy, Explore and Share.To the extent that Federal Reserve Chairman Jerome Powell and his fellow Governors and Federal Reserve Bank Presidents can work together to engineer the market's withdrawal from a decade plus of financial accommodation, the gradual outcome of the deflationary pressure on the P/E multiples of the largest Megacap companies could be the steady reflation of equity market valuations of everything else which has been creamed (such as small cap biotechnology).

Thank you Blue Room Director Minyoung Sohn

The cost of housing continues to rise all over the country. Here in Denver, Colorado, the trend is only accelerating: The average Denver apartment costs $1,877 per month for just 842 square feet. You need to be making $75,000 per year in order for that rent to be considered "affordable" at 30% of your income.

Denver's median income for 1 person is $73,400 — which means that 50% of the population can't afford an average apartment. If you make just half of the area median income at $36,700 (equal to full time employment at $17.65 per hour), you should be paying no more than $917 per month for rent.

Denver, CO Apartment Rent Ranges:

Denver, CO Occupied Housing Units

https://www.rentcafe.com/average-rent-market-trends/us/co/denver/

Participants:

Andrew Kramer — VP of Investor Relations

Colin Angle — Chairman & CEO

Keith Hartsfield — EVP & Chief Product Officer

Kiran Smith — Chief Marketing Officer

Jean Jacques (JJ) Blanc — Chief Commercial Officer

Charles Kirol — Chief Digital Business & Supply Chain Officer

Julie Zeiler — EVP & Chief Financial Officer

Analysts:

Asiya Merchant — Citigroup

Ben Rose — Battle Road Research

Derek Soderberg — Colliers Securities

James Ricchiuti — Needham

John Babcock — BofA Securities

Mike Latimore — Northland Securities

Highlights

Highlighted a strategy around Innovate, Get, Keep and Grow; stressed emphasis on software vs hardware going forward

Connected Customer base of 12.5 million will enable efficient marketing opportunities around up-selling; expects to grow to 30 million by 2024

Increasing focus on DTC channels to improve margins

Open to increasing product diversity that is complementary to the Smart Home

Provided Long-Term Financial Model (LTGM) for 2024

Revenue of $2.4B to $2.6B; CAGR of 16% - 18%

Gross Profit Margin — ~43%; Operating Profit Margin — ~12% - ~13%

EPS — $7.50 - $9.25

Strengthening supply chain through safety stock, dual sourcing, and consolidation of fulfillment operations

Anticipate cost headwinds to continue in 2022, but will dissipate into 2023 and 2024

Meaningful operating income expansion in 2023 and 2024

Since its inception in 1993, Nvidia has grown from a graphics processing chip company into an accelerated computing hardware, data warehouse with softwares stacks to complement a variety of high performance computing, graphics processing, autonomous driving, robotics, AI, and AR applications. The company reports two revenue segments Graphics and Compute & Networking. The company’s graphics segment sells Nvidia GPUs primarily under the GeForce brand including GeForce RTX GPUs for PC gaming, GeForce NOW game streaming and related infrastructure and solutions for gaming platforms, Quadro/Nvidia RTX GPUs for enterprise workstation graphics; vGPU software for cloud-based visual and virtual computing; and automotive platforms for infotainment systems. The company’s Compute & Networking segment includes data center platforms and systems for AI, HPC and accelerated computing; Mellanox networking and interconnect solutions; automotive AI cockpit, autonomous driving development agreements, and autonomous vehicle solutions; and Jetson for robotics and other embedded platforms. The Company reported 18,975 employees in 29 countries, with 71% of those employees engaged in R&D.

Phase I: A phase of research to describe clinical trials that focus on the safety of a drug. They are usually conducted with healthy volunteers, and the goal is to determine the drug's most frequent and serious adverse events and, often, how the drug is broken down and excreted by the body. These trials usually involve a small number of participants.

Phase II: A phase of research to describe clinical trials that gather preliminary data on whether a drug works in people who have a certain condition/disease (that is, the drug's effectiveness). For example, participants receiving the drug may be compared to similar participants receiving a different treatment, usually an inactive substance (called a placebo) or a different drug. Safety continues to be evaluated, and short-term adverse events are studied.

Phase III:A phase of research to describe clinical trials that gather more information about a drug's safety and effectiveness by studying different populations and different dosages and by using the drug in combination with other drugs. These studies typically involve more participants.

Phase IV: A phase of research to describe clinical trials occurring after the FDA has approved a drug for marketing. They include postmarket requirement and commitment studies that are required of or agreed to by the study sponsor. These trials gather additional information about a drug's safety, efficacy, or optimal use.

At Precision BioSciences, leaders in genome editing utilize the ARCUS editing platform to eliminate cancers, cure genetic diseases, and create safer, more productive food sources.

Genome editing technologies allow us to rethink our approach to a broad array of serious challenges faced by the world today. We now have the ability to precisely edit the DNA of a living organism, opening up the possibility of correcting genetic problems at their source.

Precision BioSciences is dedicated to improving life through its proprietary genome editing platform, “ARCUS”. Precision leverages ARCUS in the development of its product candidates, which are designed to treat human diseases in three innovative areas: allogeneic CAR T immunotherapy, in vivo gene correction, and food.

///

BLUE ROOM

GLOBAL MEETING

NUMBER SEVENTY ONE

__________ __________

Friday

December 17, 2021

8 AM Hanoi, Vietnam

__________

Thursday

December 16, 2021

6 PM Denver, Colorado

__________ __________

Dear Blue Room,

It has been an amazing second year for our company. At our last company meeting on December 2, we reflected back on 2021 and shared what we learned about ourselves and each other.

To watch the 12/2 meeting Vimeo:

Today, we are holding a rare evening so that we can incorporate the team based in Hanoi, Vietnam. Ms. Huong (and Mr. Thanh joined in November as full-time analysts and they have already started work on Microsoft and Google (Alphabet) respectively.

Going forward, the schedule for the Blue Room Global Meeting, which used to be held weekly on Thursday at 12 PM (GMT-7), will change to twice per month.

__________

Agenda:

Team Introduction: It is so valuable to have everyone know everyone. We will start with the veterans of Blue Room share their background and role on the team and then finish with the Vietnam team.

Choose one or two

Questions:

+ You unexpectedly get the day off of work or school and are commitment free: what do you do?

+ You are granted one wish, which can be enacted for 2022 or applied retroactively to 2021: what is your wish?

+ Elon Musk makes himself available to be your mentor. What do you want to learn?

+ What are your goals for 2022?

__________

DONATE

For only

$10 each

we will be purchasing and delivering blankets for the homeless.

I

N

Q

U

I

R

E

10% OF ALL BLUE ROOM REVENUES GO DIRECTLY TO FUND OUR NON PROFIT TOGETHERISM.

WE CAN ACCOMPLISH ANYTHING TOGETHER.