Weekend Update #109

Welcome to Blue Room's Weekend Update. Each week, we're sharing what companies we're researching and the what, the who and the how that we think makes the companies interesting and unique. This roundup is brought to you weekly by a group of interns, creative minds, artists and investors who believe that through best in class investing along with the democratization of financial education we can do great things together. Enjoy, Explore and Share.This week, equity prices were primarily influenced by the happenings within the U.S. economy, with a key focus on employment and inflation indicators and bank earnings. Markets began the week cautiously optimistic as traders placed tentative bets around the level of the Consumer Price Index readout. Economic indicators have provided a collection of mixed data this month with stronger-than-anticipated employment numbers clashing with lower inflation rates month-over-month. In December, headline CPI declined 0.10% and core CPI rose 0.3%, both month-to-month figures meeting economist’s forecasts. On a twelve month comparable basis, December headline CPI was 6.5% while core was 5.7%.

Inflation data coming in-line with estimates suggests that prices may have reached a peak over the summer months. Clearly, at these elevated price levels relative to the targeted 2.0%, the Fed still has a long way to go, but markets have considered the data more favorable to the chance of a softer policy rate decision in February. Generally, financial markets are pricing in a rate hike between 25 and 50 basis points at the next Federal Open Market Committee press conference on February 1st. Fed Chair, Jerome Powell spoke in Stockholm on Tuesday, but did not directly comment on monetary policy outlooks at the forum.

On Tuesday, the World Bank slashed its growth estimate for most countries and warned of the fragility of the global economy to adverse shocks. According to the organization, global GDP will likely only increase 1.7% in 2023, half the rate that was forecasted as recently as June.

In other news, American Airlines Group Inc. said that fourth-quarter profit and revenue came in above expectations, signaling resilience in travel demand over the holiday season.

On Friday, stocks finished higher as consumer sentiment data showed a drop in inflation expectations, offsetting what traders viewed as negative outlooks from big banks. Generally, the four biggest U.S. banks indicated that consumers have drawn down on savings and added debt to their credit cards, with a segment of consumers struggling to meet payments. While that may be good for bank stocks, the overall outlook for American consumers (which account for nearly 70.0% of GDP), is highly uncertain.

Friday’s Close

S&P 500 3,999.09. +2.75%

Dow Jones 34,302.61. +2.34%

Nasdaq11 079.16 +4.17%

Thank you Blue Room Analyst IAN CARTER

The much-anticipated December 2022 CPI print released January 12, 2023 at 8:30 AM Eastern revealed numbers that were in line with expectations. There was a month-over-month decrease of 0.1% in headline CPI in December, with energy and commodities being the largest contributors. These were offset by increases in food and services of 0.3% and 0.5%, respectively. On a year-over-year basis, headline CPI registered another decline in growth, from 7.1% in November to 6.5% in December. Food remained elevated, coming down slightly from 10.6% to 10.4%, while energy declined materially from 13.1% to 7.3% year-over-year from November to December. Core CPI registered a 5.7% year-over-year increase in December, down from 6.0% in November. Of note, Services less energy services, a component of CPI that is of particular interest to the Fed, increased from 6.8% in November to 7.0% in December, with shelter and transportation services being the main drivers of the increase.

Jessica Fye — Analyst

Good morning, everyone, welcome. I'm Jess Fye, I'm a large cap biotech analyst at J.P. Morgan, and we're delighted to be continuing the conference this morning with Vertex. There's going to be a Q&A session right in this room, after the company presentation, so no need to switch rooms. There's going to be a mic runner, so if you have a question, you want to raise your hand, you can do that. Alternatively you can use the portal to fire me questions to an iPad up here, and I can ask them for you, or you can just listen to my questions. But without any further ado, let me pass it over to the CEO of Vertex, Reshma Kewalramani for the presentation.

Question & Answer Session

As we think about 2023 and Lilly’s positioning heading into this year, maybe set the stage for how you’re thinking about the business?

Anat Ashkenazi — Senior Vice President & Chief Financial Officer

Lilly has shared results through Q3 2022 and will share the full year result in a few weeks

Lilly had strong growth in 2022 and had very meaningful pipeline progress

They launched Olumiant for alopecia areata

Just 6 months ago, Lilly launched Mounjaro for Type 2 Diabetes

That has been an unprecedented launch for the entire history of pharma

They are well-positioned for further growth in 2023

They’re looking at another unprecedented year in 2023 in terms of number of launches

Lilly has the opportunity to launch 4 new molecules: donanemab, pirtobrutinib, mirikizumab, and lebrikizumab

They can potentially launch a 2nd indication for tirzepatide in obesity as early as the end of 2023 or early 2024

Lilly has initiated that rolling submission in 2022

They will look to complete that submission assuming a positive SURMOUNT 2 study later this year

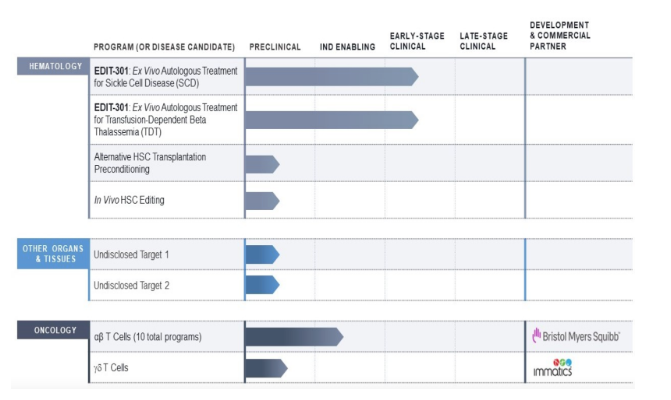

On Tuesday, January 10, Editas Medicine CEO Gilmore O’Neill presented at the 41st Annual J.P. Morgan Healthcare Conference. The presentation followed a press release that the company issued on Monday, January 9 in which they announced colossal changes to Editas’ corporate strategy.

To understand why Editas’ management team is shaking up its approach to commercializing gene editing therapies, it is necessary to contextualize the company’s current situation. In November, Editas announced clinical data from its Phase 1/2 BRILLIANCE trial of EDIT-101, an in vivo CRISPR/Cas9 genome editing medicine for LCA10, a genetic disorder of the eye. The clinical data was underwhelming, with only 21% of treated subjects meeting a responder threshold having experienced meaningful improvements in visual acuity and consistent improvements in pre-established secondary endpoints. For this reason, the company decided that it would not progress the program independently. EDIT-101 was considered the company’s flagship therapeutic at the time.

Earlier this week, Fed Chair Jerome Powell made remarks at the Sveriges Riksbank International Symposium on Central Bank Independence. While not touching on future monetary policy directly, he did make a few key points on the US context:

The Federal Reserve’s monetary policy independence has served the American public well

The Fed must continuously earn that independence by using its tools to achieve its assigned goals of maximum employment and price stability

The Fed should “stick to its knitting” and not wander off to pursue perceived social benefits that are not tightly linked to their statutory goals and authorities

Of note, he indicated that restoring price stability “can require measures that are not popular in the short-term as they raise interest rates to slow the economy.” The Fed is able to do so thanks to its independence as it allows monetary policy to be insulated from short-term political considerations. Currently, markets are pricing in rate cuts in 2023 as they anticipate lower inflation and/or a recession that will induce the Fed to “cave,” but based on the aforementioned commentary, the Fed is very much willing to take on monetary policy that may not necessarily be popular in the short-term i.e., hold rates higher for longer. Full text of Powell’s remarks can be found below.

Josh Reilly — Analyst, Needham

My name is Josh Reilly, and I'm an analyst on the enterprise software team. This morning, we have Todd McElhatton, the CFO of Zuora. We're going to do a little bit of a fireside chat here.

So -- all right, Todd, so maybe we can just start off with an overview of Zuora for those who are less familiar with the company.

Todd McElhatton — Chief Financial Officer

So thanks a lot Josh for hosting us today. Glad to be here.

Zuora was started by Tien Tzuo. Tien was the Former CMO of Salesforce. And what he was seeing there was, as they were moving or a subscription company, there were no products, whether they be ERP products or building yourself ability to how do you manage a subscription business. And so that's where we got our start as a subscription billing solution and we were primarily focused on technology companies.

Fast-forward today, we have the Zuora platform, which can help companies manage end-to-end the order-to-cash process. And not only are we helping companies with their subscription businesses, but with all types of businesses.

Kevin Conroy — Chief Executive Officer, President & Chairman

Remember these numbers: 1, 5, 7, 9, 14, and 10 million

In 2009, Kevin had a meeting that changed everything

The Exact Sciences board was looking for a CEO to restart the company

The problem was they had no R&D team left after a decade of work and no proof-of-concept

So, the board recommended he meet Dr. David Ahlquist — Mayo Clinic physician and renowned cancer researcher

He was focused on early detection and prevention of colon cancer

It was a one-day meeting

Kevin left the meeting knowing he would join Exact Sciences, they’d partner with Mayo Clinic, and that they’d develop Cologuard

The first thing they did was partner with Dr. Graham Lidgar — Chief Science Officer, Emeritus

He was a legendary molecular scientist, who build the team of research and development scientists, biostatisticians, clinical affairs team, lab team, automation team to develop Cologuard

FINANCIAL MODELING

+201+

LULULEMON

_____

Monday

January 9, 2023

9 AM

BLUE ROOM

FINANCIAL MODELING 201

ADVANCED EXERCISE

LULU: Lululemon

_____

Stock is trading down 10% to $295 on revised earnings guidance. We are parsing through the language and deciphering the impact on margins and EPS. What do we discover?

Thursday

January 12, 2023

12 PM

BLUE ROOM

GLOBAL MEETING

NUMBER 105

__________ __________

Happy New Year!!!

Agenda

I. Blue Room Investing

+ Marketing Calendar

+ Growing the Team in 2023

II. Blue Room Impact

+ Housing

+ Grain, Commodities, Twin Peaks

+ Art

Questions:

1. What did you have for breakfast this morning? Do you eat breakfast?

2. You have one hundred billion dollars of discretionary spending power granted to you by Congress. Is that enough to solve the greatest challenge you will tackle?

U.S. ++ VIETNAM

— Combined Team Meeting —

__________

Tuesday, January 10, 2023

7 AM / Hanoi, Vietnam

__________

Monday, January 9, 2023

5 PM / Denver, Colorado

__________

— I C E B R E A K E R —

What is your Favorite Food?

F

U

N

D

O

N

E

IS LIVE

10% OF ALL BLUE ROOM REVENUES GO DIRECTLY TO FUND OUR NON PROFIT TOGETHERISM.

WE CAN ACCOMPLISH ANYTHING TOGETHER.

These materials do not purport to be all-inclusive or to contain all the information that a prospective investor may desire in considering an investment. These materials are intended merely for preliminary discussion only and may not be relied upon for making any investment decision. Any discussion or information contained in this presentation does not serve as a receipt of, or as a substitute for, personalized investment advice from Blueroom or your advisor.

This publication does not constitute an offer to sell or a solicitation to buy any securities in any fund, market sector, strategy or any other product. Investing is speculative and involves substantial risks (including, the risk of loss of the investor’s entire investment). Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable.

For more information about us and our general disclosures contact us directly.