Weekend Update #105

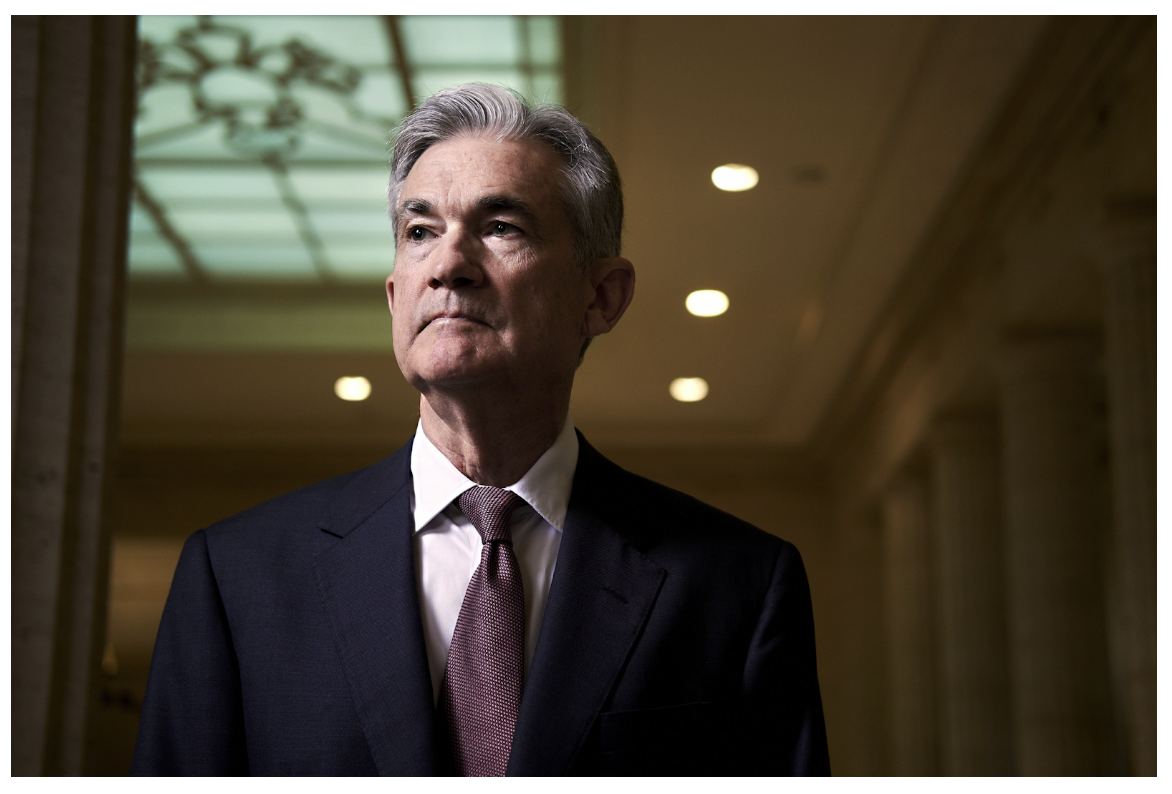

Welcome to Blue Room's Weekend Update. Each week, we're sharing what companies we're researching and the what, the who and the how that we think makes the companies interesting and unique. This roundup is brought to you weekly by a group of interns, creative minds, artists and investors who believe that through best in class investing along with the democratization of financial education we can do great things together. Enjoy, Explore and Share.Although U.S. equity markets saw a positive start to the week and got a boost from cooler than expected inflation, the Federal Reserve raised interest rates by 50 basis points on Wednesday, largely as expected, and Fed Chair Jerome Powell’s press conference remarks began a selloff that lasted through the end of the week. The S&P 500 closed the week at 3,852.36 (-2.08%), the Dow Jones Industrial Average closed at 32,920.46 (-1.66%), and the Nasdaq Composite closed at 10,705.41 (-2.72%).

One of the most exciting announcements of the week came on Tuesday as Moderna and Merck reported promising results from an mRNA therapy for melanoma patients. In combination with Keytruda, a cancer drug from Merck, Moderna’s mRNA-4157/V940 reduced the risk of death or recurrence by an impressive 44% in melanoma patients. MRNA stock saw a 20% gain on the results on Tuesday.

In economic data for the week, Tuesday’s Consumer Price Index report came in below expectations for the second straight month — a welcome sign for the Federal Reserve. Month-over-month, CPI rose just 0.1% in November, and year-over-year, the headline and core readings were 7.1% and 6.0%, respectively. Shelter costs and food prices continued to contribute positively to inflation but were offset by continued declines in energy and automotive prices. The Small Business Optimism Index rose 0.6 points in November to 91.9, beating survey estimates of 91.3 but remaining below the 49-year average of 98 for the 11th consecutive month. Inflation remains the top concern for small business owners. Retail sales contracted -0.6% month-over-month as rate hikes weighed on consumer spending. Initial jobless claims also rose less than expected by 211,000 for the week ended December 10th, in a sign of a persistently tight labor market.

In other news, uncertainty in cryptocurrencies grew as FTX founder Sam Bankman-Fried was arrested in the Bahamas for fraud and conspiracy, SpaceX’s valuation continued to grow as its latest fundraising round valued the company at $140 billion, and the U.S. Department of Energy announced the achievement of fusion ignition — a net gain of energy — that means nuclear fusion might be able to produce energy with relatively small amounts of radioactive waste in the future.

Thank you Blue Room Analyst JARED FENLEY.

FOMC Statement

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures. Russia’s war against Ukraine is causing tremendous human and economic hardship. The war and related events are contributing to upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4-1/4 to 4-1/2 percent. The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

“The historical record cautions strongly against prematurely loosening policy.”

— Jerome Powell, December 14, 2022

The Historical Record

What is this “historical record” the Fed keeps referring to? The answer: the 17 years of persistent inflation seen from 1965-1982 — despite increasingly higher interest rates in response. The failure of monetary policy identified from this period is that the Federal Reserve was too quick to resort to cutting interest rates to stimulate the economy through a recession, as even 3 recessions couldn’t return inflation to the target rate.

As respectable 21st-century economists and stewards of history, the easiest way for Jerome Powell and the FOMC to stain their monetary policy records would be to allow a repeat of that inflationary period when history has already signaled the solution: higher interest rates for longer.

Federal Reserve Chairman Paul Volcker finally “cured” inflation after the Federal Reserve had taken interest rates to 9 distinct peaks over a 20-year period, but only by raising rates to almost 20% after inflation had climbed so high.

The Federal Reserve’s plan for 2023 that Powell has messaged is far from the “Volcker Shock” moment seen in the 1980s, but the main takeaway is that the FOMC is committed to driving inflation back to the 2% target in one hiking cycle — not multiple. What this entails might mean less economic stimulus in the scenario that the economy begins contracting due to high interest rates yet inflation’s path to 2% is slower than expected.

Empire State Manufacturing (survey data recorded since July 2001)

Participants from across the state in a variety of industries respond to a questionnaire and report the change in a variety of indicators from the previous month.

Respondents also state the likely direction of these same indicators six months ahead.

The indicators on the survey are calculated by adding the percentage of increase responses and subtracting the percentage of decrease responses. (ex. 30% of survey respondents chose increase and 21% picked decrease, the index would read a “9”).

Analysis of Data Release

On Tuesday, December 13, Moderna and Merck announced positive clinical results from Moderna’s personalized cancer vaccine in combination with KEYTRUDA. While the two companies have yet to release specific statistics related to the Phase 2b clinical study, the headline numbers were extremely encouraging. The joint press release commented that the “adjuvant treatment with mRNA-4157/V940 in combination with KEYTRUDA reduced the risk of recurrence or death by 44%.” Not only is this headline data inspiring given that it provides evidence supporting the possibility of a new adjuvant cancer treatment, but also validates the technology underlying mRNA vaccines for use in areas outside of COVID-19 and infectious diseases.

Moderna and Merck have been working together to create an adjuvant cancer therapy for more than six years. Indeed, oncology was one of Moderna’s principal areas of focus before it was thrust into the world of infectious diseases in early 2020. The goal of Moderna’s personalized cancer vaccine (PCV) was to prime the immune system so that a patient could generate a tailored antitumor response to their tumor mitigation signature to treat their cancer. To this end, mRNA-4157 is designed to stimulate an immune response by generating T cell responses based on the mutational signature of the patient’s tumor. In effect, mRNA-4157 is tailor-made for each patient based on the mutations specific to his or her cancer so that the immune system is better able to fight the cancer. The headline data provided evidence that the therapy worked as intended: mRNA-4157 was able to improve patients’ immune response, making Marck’s cancer therapy more efficacious.

Consumer sentiment rose 4% above November to 59.1 in December, recovering most of the losses from November but remaining low from a historical perspective.

All components of the index lifted, with one-year business conditions surging 14% and long-term business conditions increasing a more modest 6%.

Gains in the sentiment index were seen across multiple demographic groups, with particularly large increases for higher-income families and those with larger stock holdings, supported by recent rises in the financial markets. Sentiment for Democrats and Independents rose 12% and 7%, respectively, while for Republicans it fell 6%.

Throughout the survey, concerns over high prices — which remain high relative to just prior to this current inflationary episode — have eased modestly.

Thursday

December 15, 2022

12 PM

BLUE ROOM

GLOBAL MEETING

NUMBER 103

__________ __________

BLUE ROOM

Global Meeting #103

Holiday Meeting

__________ __________

Agenda

I. Blue Room Updates

-- Emily and Jim

II. Blue Room Investing

-- Omar: Federal Reserve

III. Blue Room Impact

-- Housing

-- Art

-- Agriculture

Icebreaker: What do you want from Santa this year? What does the world need from Santa this year and next?

“We’re pleased with the start of the holiday season, however, the environment remains dynamic and we still have approximately two-third of the quarter ahead of us.

-Meghan Frank, Chief Financial Officer of Lululemon Athletica, Inc.

BLUE ROOM ANALYST TAKEAWAYS

3Q22 Actual Performance:

Beat consensus ($1.857 billion vs. $1.814 billion expected)

GAAP EPS beat ($2.00 vs. $1.98 expected)

Gross margin missed (55.95% vs. 56.68% expected)

4Q22 Guidance:

Revenue misses: $2.630 billion guided vs. $2.659 billion expected

EPS misses (GAAP): $4.25 guided vs. $4.31 expected

FY22 Guidance: Although revenue at the mid-point was again revised upward, it was marginally above consensus estimates which seems not enough to satisfy investors in post-market. EPS also comes in lower than market:

Revenue meets: $7.969 billion guided vs. $7.963 billion expected

EPS: $9.99 guided vs. $10.07 expected

Difference between BLUE ROOM 4Q22 estimates and guide is based on a 45.0% COGS vs. 41.0% to 42.0% COGS implied from company guidance. Company guidance assumes full pricing of inventory. We are less optimistic about inventory pricing than the company and general consensus. We believe that one of two things will occur:

Either lulu marks down now inventory to lower the DIOs figure or,

Lulu takes longer to sell through products during the deflationary period and faces margin pressure from inventory bought during high inflation.

Both of these reasonably logical outcomes imply slower-than-expected revenue growth over the next few quarters and lower margin.

Nothing regarding abnormal inventory markdowns was mentioned in the guidance outlook for next quarter, and in Q & A the company maintained that they will continue to be a “full-price” brand.

— AS —

NATHANIEL RATELIFF & THE NIGHT SWEATS

GEAR UP TO

HEADLINE THEIR FIRST ARENA SHOW

IN DENVER, CO ON FRIDAY, DEC 16TH,

WE REPUBLISH THIS TRIBUTE FROM NEWSLETTER #17.

ON FEBRUARY 13TH NATHANIEL RATELIFF MAKES HIS SNL DEBUT

Chapter One

(of Three)

Growing up in rural Missouri, Nathaniel Rateliff got his early music education from his family, who performed in the church band in which Nathaniel played drums. Nathaniel’s father was killed in a car crash, which forced Nathaniel to drop out of seventh grade and end his formal education. He immediately took a job to help provide for his family, working at the local plastic factory and then Subway. One of Rateliff's full-time jobs was working as a janitor at what would have been his high school. Four years after his father’s accident, Nathaniel’s mother moved to Texas with her new husband. At that point, Nathaniel moved in with his best friend, Joseph Pope and his family(Joseph took Nathaniel as his date to the high school senior prom that Nathaniel should have been attending on his own). At 19, Nathaniel left Missouri for Colorado on a missionary trip as a way of getting out of his hometown. As Nathaniel recounts, he was actually the one to be converted by the Native Americans. Then, Rateliff moved to Denver, where he still resides twenty years later. In his early days in Denver, he worked night shifts at a bottle factory and then spent ten years working on the loading dock of a trucking company while testing out songs at open-mic nights.

An intense local buzz grew about Nathaniel and led to Nathaniel landing a record deal with Rounder Records. Rateliff’s 2010 solo album, ‘In Memory of Loss’, propelled him to the forefront of Denver’s music scene, with The New York Times dubbing him “a local folk-pop hero”. From that point on Nathaniel would start his career as a hard working musician. He toured extensively in North America, the UK, and Europe to critical acclaim and small audiences, all the time with his guitar player, bass player and still best friend Joseph Pope by his side. Never returning from tour with enough money, Rateliff kept day jobs when back in Denver mainly getting his hands in the dirt as a landscaper.

Reflecting on his mothers move to Texas Nathaniel remarked “My mom was just in her mid-30s. She didn’t know what the f*ck was going on either. I told her, ‘I don’t blame you. It’s not what cards you’re dealt, it’s how you play them.’ I think it was [science-fiction writer] Ursula Le Guin in The Earthsea Trilogy who says, ‘Never trust someone without a limp.’ Character isn’t defined by our strengths but by what we overcome,” says Rateliff.

( TUNE IN NEXT WEEK FOR )

Chapter Two

F

U

N

D

O

N

E

IS LIVE

10% OF ALL BLUE ROOM REVENUES GO DIRECTLY TO FUND OUR NON PROFIT TOGETHERISM.

WE CAN ACCOMPLISH ANYTHING TOGETHER.

These materials do not purport to be all-inclusive or to contain all the information that a prospective investor may desire in considering an investment. These materials are intended merely for preliminary discussion only and may not be relied upon for making any investment decision. Any discussion or information contained in this presentation does not serve as a receipt of, or as a substitute for, personalized investment advice from Blueroom or your advisor.

This publication does not constitute an offer to sell or a solicitation to buy any securities in any fund, market sector, strategy or any other product. Investing is speculative and involves substantial risks (including, the risk of loss of the investor’s entire investment). Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable.

For more information about us and our general disclosures contact us directly.