Weekend Update #021

Welcome to Blue Room's Weekend Update. Each week, we're sharing what companies we're researching and the what, the who and the how that we think makes the companies interesting and unique. This roundup is brought to you weekly by a group of interns, creative minds, artists and investors who believe that through best in class investing along with the democratization of financial education we can do great things together. Enjoy, Explore and Share.INTEREST RATES, TESLA, AMAZON, GAMESTOP

Interest rates - which typically move inversely with the stock market - continue to rise, experiencing the highest one-month growth in four years as the 10-year treasury bond yield briefly rose to a one-year high of 1.6%. Concerned investors are beginning to reduce their positions, causing big name tech stocks like Tesla and Amazon to drag the Nasdaq down over 3% this week and 6% from its all-time high. In addition, GameStop, along with other “meme” stocks, has reignited, with GME surging over 250% and reviving volatility concerns - also contributing to broader market losses.

Check out BLUE ROOM ART for project profile

— BREVE HISTORIA DE UN CAMINO: DEL NEGRA AL COLOR —

A principios del 2020, pese a la situación de la pandemia, el estudio Sarabia que se conformaba apenas por 8 personas encontró una oportunidad de crecer. A partir de la colaboración con Blue Room, el artista Eduardo Sarabia tendría la oportunidad de echar a volar un proyecto de pintura al óleo, amplio, pero de mediano plazo, que surge a partir de su interés por las intrahistorias y su particular forma de relato.

Gracias a la colaboración con Paulina Barragán, este proyecto que no había encontrado el tiempo para llevarse a cabo con anterioridad, encontró su espacio natural. En junio de 2020 el Estudio Sarabia se mudo a una finca sobre la calle de Independencia 795, en el centro de Guadalajara, México. Ese sitio había sido un espacio triste, una funeraria, pero ahora brindaba la posibilidad de crear un espacio de luz y color, y de conectar con otras personas que, juntas, podrían estar mejor.

Se realizó la adecuación del espacio: un área de pintura de acrílico en la parte de arriba, una cocina y un patio para compartir y también, abajo, varias áreas dedicadas a la pintura al óleo, y al resguardo de cuadros de mediano y gran formato. El proyecto de rehabilitación del sitio estuvo a cargo de Lalo Sandoval, quien también fabricó el mobiliario de almacén y al inicio del proyecto protagonizó la inauguración preparando tortitas ahogadas para todo el equipo.

El corazón del espacio es ahora la gran sala de producción al óleo, pero los pulmones están en el patio donde hay un recordatorio de que “El Amor es la Droga” y el cual se ha convertido en punto de reunión y de celebración el día de cumpleaños de algún integrante del equipo.

En el Estudio Sarabia trabajan y habitan dieciocho personas, artistas jóvenes en su mayoría, y sus nombres son Eduardo Sarabia, Paulina Barragán, Julián Jaime Contreras (Director Artístico), Sandra Santiago (Coordinadora de Estudio), Karen Zavala, Iris Zambrano, Diego Velázquez, Juan José Ramírez, Georgina Montes, Alejandra Ruiz, Yolanda Vega, Edgar Cobián, Jessica Almeida, Claudia López, Iván Quintero, Manuel García, Viviana Ramírez y Lorena Peña.

— PIES DE FOTO —

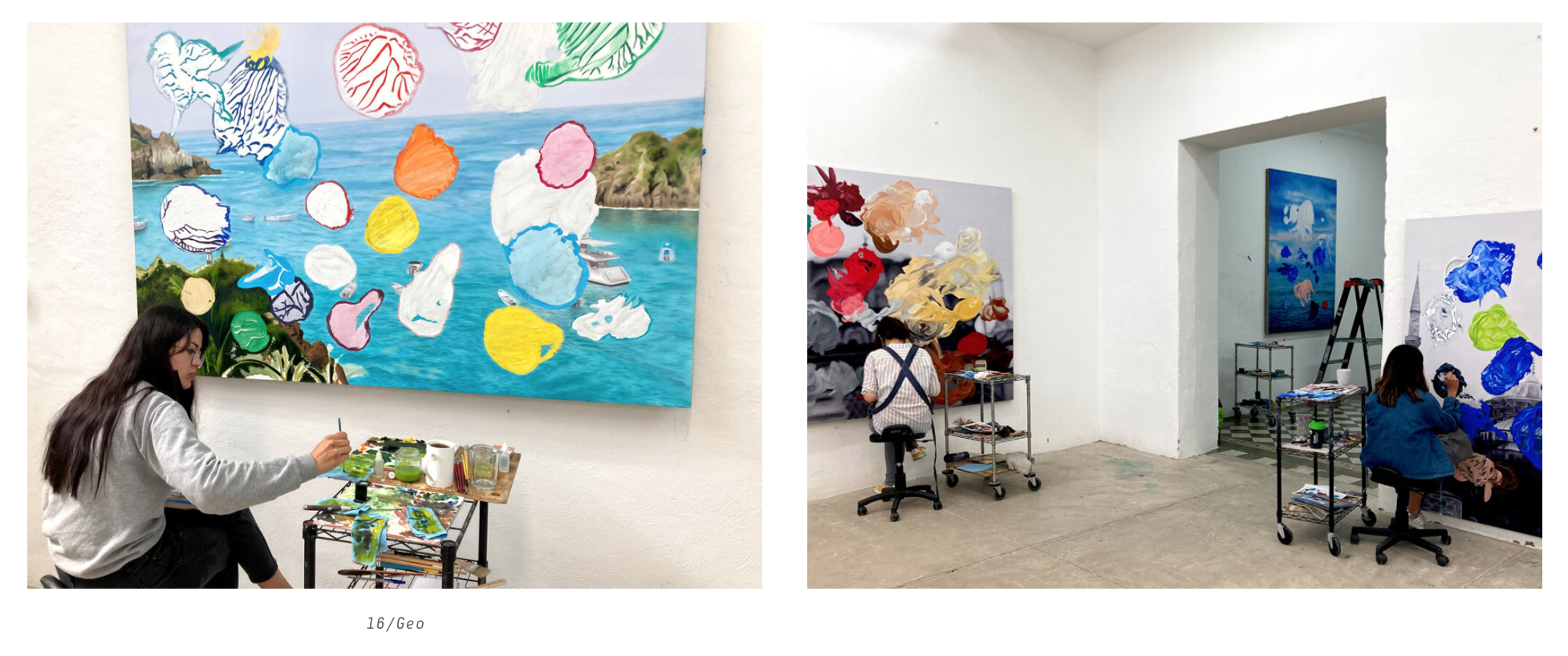

Image 16. Geo

Georgina Montes estudió arte en la Universidad de Guadalajara, especialidad en pintura y grabado. Fue codirectora del Taller de Gráfica La Tinta Negra por tres años. Ha expuesto su obra en México, Inglaterra y Alemaniam y ha sido invitada a residencias en distintos talleres de grabado en el país.

Image 22. Alex

Alejandra Ruiz es artista, estudió arte en la Universidad de Guadalajara, ha realizado residencias y exhibiciones individuales y colectivas en múltiples instituciones y actualmente es docente universitario.

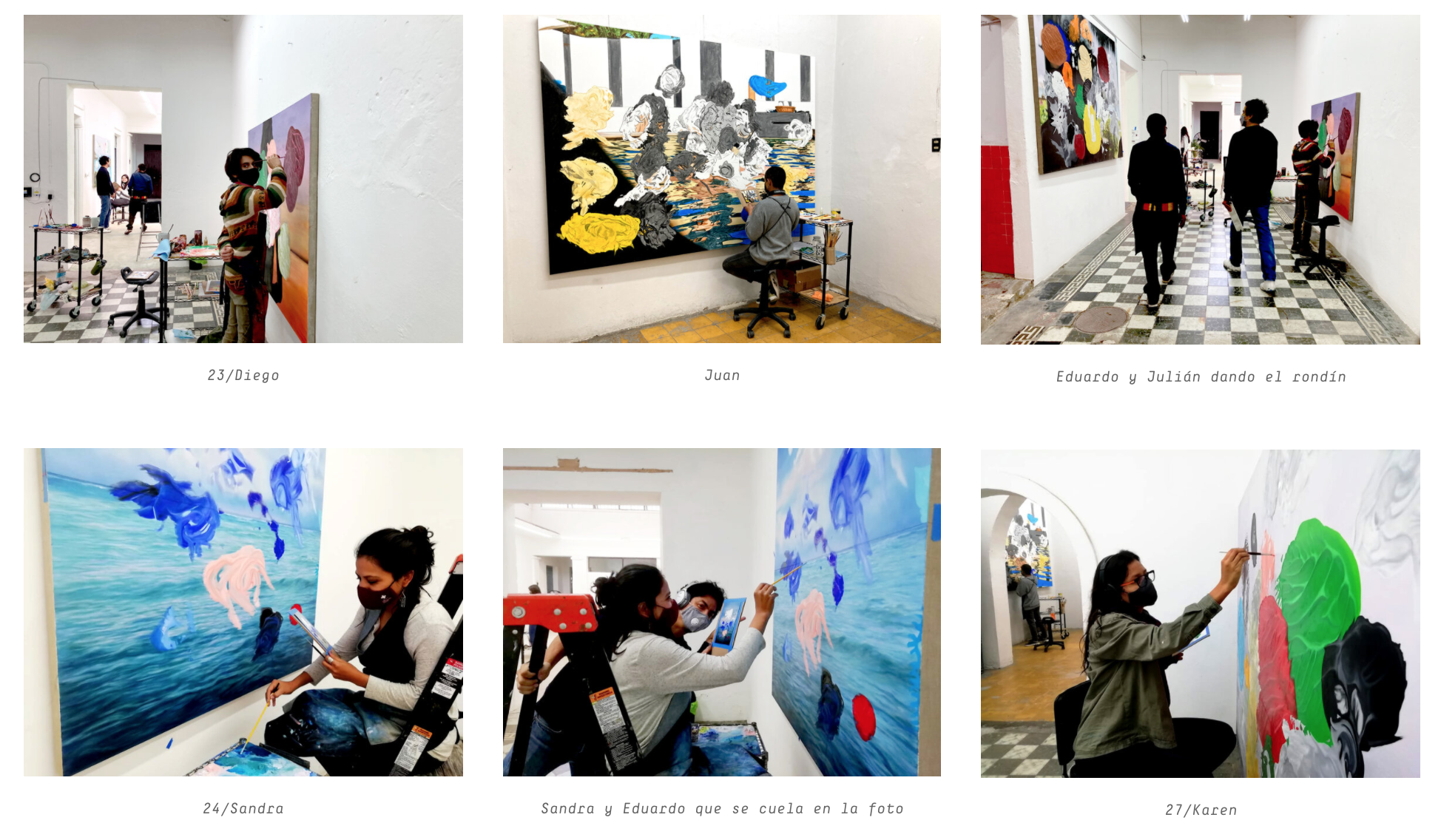

Image 23. Diego

Diego Velázquez también estudió arte en la Universidad de Guadalajara. Empezó a dibujar a los 9 años y profesionalmente a los 16.

Image 24. Sandra

Sandra Santiago (Coordinadora de estudio) es creadora y docente artística, enfocada en la destilación de hierbas a partir de su proyecto personal “Herbaria”. Ha trabajado en estudio Sarabia por 4 años hasta ahora.

Image 27. Karen

Karen Mirelle Zavala tiene 20 años, a su corta edad está muy interesada en los procesos artísticos, y ha desarrollado su educación en distintos talleres en instituciones como la Universidad de Guadalajara y Museo Cabañas. Actualmente cursa la Licenciatura de Conservación y Restauración en la ECRO.

Image 32. Julián en bodega

Julián Jaime Contreras es el Director Artístico del estudio. Es Lic. En Pintura y Grabado por la Universidad de Guadalajara y ha trabajado en el Estudio Sarabia por más de 15 años. Comparte con Eduardo su afición por el ajedrez y es amante empedernido de los perros.

— Cita final —

“Últimamente ha sido una gran experiencia producir con nuevos colaboradores, el año pasado contraté a 10 nuevos pintores para que me ayudaran con la producción. Me gusta la energía que se está creando y también estoy muy feliz de poder ayudar a los artistas más jóvenes durante estos tiempos difíciles. Cuando era pequeño, tuve mucha ayuda y ahora tengo la suerte de llegar a un punto en mi carrera en el que puedo hacer lo mismo. El estudio se ha convertido en un lugar creativo para aprender unos de otros”

Eduardo Sarabia.

— Eduardo / DESERT X —

Desert X announced the participating artists in its third edition of the site-specific, international art exhibition opening March 12 – May 16, 2021 at sites across the Coachella Valley. Thirteen artists from eight countries will be presented in the exhibition curated by Artistic Director Neville Wakefield and Co-Curator César García-Alvarez. Desert X 2021 will be among the first art experiences in the region since widespread lock-downs, offering a safe, outdoor experience that is free and open to all.

Eduardo Sarabia (born 1976, Los Angeles, US, based in Guadalajara, Mexico)

featured at Desert X.

My family’s story began amidst the backdrop of the western front during World War II. My paternal great grandfather and first generation Mexican American volunteered for the army and served at the age of 20. My maternal grandfather, the quintessential hard working Mexican-American in every sense of the word, dropped out of school in the 8th grade to help provide for his then growing family of seven. Through many hours of blood, sweat, and tears working as a migrant farmer, his hope for a better future was finally starting to take shape.

As a result of my grandfathers’ hard work and great sacrifice, my parents were able to pursue college education. My mother and father stressed education and made sacrifices such as cleaning our school to help pay off our private school tuition. The American Dream that was promised to my great grandfather when he fought for our freedoms against Nazi Germany was finally within our reach.

Through the morals and values instilled through our family, parents, and Hispanic culture, we started on a path which my dad said, “would change our family tree”. The one defining moment in our family's long and hardfought journey to this goal was finally reached in 2016. My older brother Jacob, signed to play football for the Green Bay Packers. That Fall our entire family gathered to watch my brother play his first few snaps of NFL football. In attendance that day was our maternal grandfather. I vividly remember looking over and watching tears stream down his face. Tears of joy and elation, tears for all the hard work and sacrifice, but most importantly tears that signified the combinations of a dream completed through four generations of Mexican-Americans.

My dream is to also one day play in the NFL.Unfortunately only 2% of NFL players are Hispanic which is immensely disproportionate when the United States is almost 18% Hispanic. Nonetheless, I hope to bring my grandfather’s dream to life, but I also hope to provide a platform for Hispanic youth to achieve similar aspirations and see themselves represented more broadly on a national stage.

Anne Isabella Thackeray Ritchie, is credited with the first English literary reference to the following proverb in her novel "Mrs. Dymond" (1885)

+ Give a man a fish and you feed him for a day;

+ Teach a man to fish and you feed him for life.

__________ __________ __________

LinkedIn

"Come ye after me, and I will make you to become fishers of men."

Mark 1:17

__________ __________ __________

Fish,

Fishing,

Fisher.

Fishing for a New Stock Idea,

Finishing up the Final Tweaks

Of a Financial Model,

Life is Good,

Right?

__ __

No.

K?

__ __

Yes,

We Must

Rise to Action

Together, Is Power

Together, We Can Accomplish

Anything,

And, I Mean Anything.

__________

Blue Room is a #startup private investment company born of Invention, Forward Thought and #Hope

One way to provide hope is to provide a means to provide for oneself, and their loved ones,

Truly.

We are putting it all out there on the line for all to see and to inspect, and perhaps even learn.

__________

Chegg Inc. in an American educational services company valued at approximately USD thirteen and a half billion dollars.

Over the past 7 years,

#Chegg has completed a #metamorphosis

From Bookseller

To Fisher Maker

Overview:

Revenue for the year ended December 31, 2020 increased 19% to $1.66 billion vs $1.4 billion for full year of 2019

Revenue for fourth quarter increased 19% to $444 million from revenue of $375 in the fourth quarter of 2019

Net income (excluding a one-time charge related to the terminated RentPath acquisitions) was $271 million or $7.08 per diluted share

Dry Storage had an exciting week hosting David Haynes of Re-plant Capital learning more about the work he is doing — from the top down — to support large scale farms employing regenerative soil practices.

It is always exciting to talk about the role of grains and their power to create CHANGE but when activism truly gets sublime is when a chef leads the charge — yes our grains have more protein, fiber, no additives/enhancements while supporting the farmer/planet BUT THE MOST PROFOUND moment is when you try a baguette or smørrebrød on fresh rye at the bakery. Please stop by and tell them Blue Room sent you.

Whether you believe silver will appreciate in value over time or you’d like an asset that provides diversification benefits, whatever the case may be, there are several ways to increase your silver exposure.

1. Physical silver — I once had a roommate back in Boulder (whose mattress I did not steal)(1) who collected gold and silver coins. This was in 2015 - he was a staunch Republican and Obama was in office. He believed that because the US was continuing to grow its already-enormous budget deficit and fiscal spending would spiral out of control with a Democrat in office, inflation would run rampant, and the only way to hedge was by owning precious metals.

I’ll confess I thought he came off a bit crazy when he told me all of this while opening his safe and showing me his coins (I was expecting him to then show me his doomsday bunker). Indeed, inflation has yet to materialize the way he predicted it would. In 6 years’ time he’s made 6.7% on a compounded annual growth rate basis (with most of the gains having been made within the last year). Had he instead invested in $SPY, the S&P 500 ETF, he would have made about 11% compounded annually. However, I do think this time is different for the reasons I’ve laid out in the earlier parts of my series, and now I think it’s perfectly fine, if not preferable, to own physical silver.

I recognize this may sound like a 4 AM infomercial on ESPN blaring from an 85” flat-screen on the first floor of a fraternity house a few hours after the late Saturday-night PAC 12 college football games have wound down and (mostly) everyone has retired to their bedrooms, but I promise you, this is legit.

——————

Numismatics (nu·mis·mat·ics) | \ ˌnü-məz-ˈma-tiks

: the study or collection of coins, tokens, and paper money and sometimes related objects (such as medals)

——————

Coins

It was news to me when I found out that the United States Mint still exists. I’m joking of course, but I was surprised to find that they still produce actual silver dollars (they are legal tender, after all) and distribute through authorized Bullion Dealers.(2) You’ll find that newer coins sell for quite a bit of a premium, much more so than rounds (see below) due to not only retailer mark-up and numismatic value, but also, unprecedented demand – the US Mint recently stated it literally couldn’t meet surging demand for its gold and silver bullion coins.(3)

A more pragmatic approach would be to find coins whose value is closer to spot prices- these tend to be older, worn coins, since their value is primarily derived from their metal content, not artistic value. Whether new or worn, another benefit of coins is that if in the unlikely event that silver prices were to crash, they would still be redeemable for their face value.

Rounds

Rounds look like coins but they’re not legal tender. Dealers, like APMEX, sell rounds that have unique artistic designs and are closer to spot prices than coins, but nevertheless also sell at a premium (about 17% above the silver spot price). First Majestic Silver also has their own online bullion store, and both dealers ran out of physical inventory in late January/early February when silver prices spiked over the weekend.

Bars

APMEX also sells bars weighing anywhere from 1 ounce to 1 kilo, and are also a great choice if you want physical silver. This should go without saying but whatever you end up buying, make sure you’re buying from a reputable dealer.

2. Sprott Physical Silver Trust (PSLV) (the “Trust”) is a closed-end (very important) mutual fund trust.(4) The goal of the Trust is to provide a secure, convenient and exchange-traded investment alternative for investors who want to hold physical silver. Each trust unit represents an equal, fractional, undivided ownership interest in the net assets of the Trust and may at times trade at a premium to its net asset value (NAV). Because PSLV is a closed-end fund, its managers are not able to create new shares to meet investor demand.

The Trust only holds fully allocated and unencumbered silver - meaning the silver bullion is owned by the investor and is stored in his or her name in a bank or third party vault – in this case, the Royal Canadian Mint. According to its Prospectus, the Trust is prohibited from investing in silver certificates or other financial instruments that represent silver. In other words, with the exception of cash and cash equivalents, the only other thing it can hold is physical silver.

Unitholders of PSLV, if they are so inclined, may redeem their units for actual physical silver bullion. In the case of PSLV, you would need enough units to equate to ten 1,000 oz silver bars. PSLV’s custodian (The Royal Canadian Mint) can deliver the bars almost anywhere in the world via an Armored Transportation Service Carrier (provided, of course, that the unitholder cover the delivery expenses, including the handling of the redemption notice and applicable storage in-and-out fees).

PSLV also offers potential tax advantages for certain non-corporate U.S. investors – gains realized on the sale of the Trust’s units can be taxed at a capital gains rate of 15%/20% versus the 28% collectibles rate applied to most precious metals ETFs, coins and bars.(5)

As of 4 PM EST on February 22, 2021, PSLV owned 120,267,971 ounces of silver. At a price of $28.14 per ounce, the total market value of silver held within Trust was $3,384,088,145 and the net asset value of the trust was $3,406,031,732 (the balance is comprised of cash and cash equivalents). With 335,735,583 units outstanding, the net asset value per unit was $10.14.

Some differences between PSLV and the iShares Silver Trust (SLV) include the following. PSLV can only hold physical, fully-allocated silver, whereas SLV is allowed to hold “unallocated silver” i.e., “paper silver.” Additionally, SLV is an open-ended fund, which means its managers are not limited to how many shares they can issue. The aim of SLV is to “reflect generally the performance of silver,” per its Prospectus.(6) It goes on to say “Although the Shares are not the exact equivalent of an investment in silver, they provide investors with an alternative that allows a level of participation in the silver market through the securities market. It further states “the bulk of the Trust’s silver holdings is represented by physical silver, identified on the Custodian’s or, if applicable, sub-custodian’s books, in allocated and unallocated accounts on behalf of the Trust and is held by the Custodian in London, New York and other locations that may be authorized in the future.”

Allocated accounts own the silver outright and the bank is simply the custodian, while unallocated accounts are “credited” silver but the bank or dealer owns the metal. In essence, as an unallocated account, you’re a creditor as opposed to a true owner. The Trust cannot hold more than 1,100 ounces in unallocated form (which is a relatively very small amount) but it is indeed a difference it has when compared to PSLV.

An interesting clause SLV added to its Prospectus is the following:

“The demand for silver may temporarily exceed available supply that is acceptable for delivery to the Trust, which may adversely affect an investment in the Shares.” Authorized Participants may not be able to readily acquire sufficient amounts of silver necessary for the creation of a Basket. Baskets may be created only by Authorized Participants, and are only issued in exchange for an amount of silver determined by the Trustee that meets [certain specifications]. This may cause the market price of SLV to deviate significantly from its net asset value (on the upside) and applies to PSLV as well since it is a closed-end fund.

3. Mining Companies – Perhaps the riskiest of the three ways to obtain silver exposure (physical silver, physical silver ETFs, or ETFs that track silver miners), investing in mining companies may be suitable for the investor with higher risk tolerance. I’ll stop short of recommending any one company in particular, but what I can do is lay out a few options.

Global X Silver Miners ETF (SIL) – tracks a market-cap weighted index of companies actively engaged in the silver mining industry. Its top 5 holdings include:

Wheaton Precious Metals (WPM)

Polymetal International Plc (POLY)

Pan American Silver Corp (PAAS)

First Majestic Silver Corp (AG)

Hecla Mining Company (HL)

ETFMG Prime Junior Silver Miners ETF (SILJ) – Provides direct exposure to the silver mining exploration and production industry. It is the first and only ETF to target small-cap silver miners. Its top 5 holdings including

First Majestic Corp (AG)

Hecla Mining Company (HL)

Pan American Silver Corp (PAAS)

Mag Silver Corp Com (CN: MAG)

Yamana Gold Inc (AUY)

If you don’t have the time to research individual silver companies, adding one of these ETFs may be sufficient exposure to silver mining companies, but if you’re looking for mining companies to research, looking at existing ETFs’ top holdings is a great place to start.

As always, please consult with your financial advisor before making any investment decisions. The above is meant to inspire further research and new investment ideas and is not meant to serve as financial advice.

-FIN-

1 https://genius.com/The-chainsmokers-closer-lyrics

2 https://catalog.usmint.gov/bullion-dealer-locator

3. https://www.reuters.com/article/usa-precious-coins-demand/us-mint-unable-to-meet-demand-for-gold-silver-bullion-coins-idUSL1N2K82XU

4. https://sprott.com/media/1718/pslv-kid.pdf

5. https://sprott.com/investment-strategies/physical-bullion-trusts/pslv-dont-overpay-for-silver/

6. https://www.ishares.com/us/products/239855/ishares-silver-trust-fund

February 25, 2021 Blue Room Meeting #040

Thursday

February 25, 2021

12 PM BLUE ROOM

__________ __________Thursday Meeting

Number Forty

__________ __________

This week, we have been actually engaged in conversational topics such as:

+ How do have confidence in what you "know"

+ How do you learn the truth about someone

+ How do you get involved with a stock, without taking it "personally" ("You are not your stock")

Question: Where do you see yourself at the Age of 40?

__________ __________

P L E A S E E N J O Y T H E

—WEEKLY—

company updates

from the BR intern team.

AIDAN FETTERLY

Ticker: APPL

Name: Apple, Inc.

Number of Shares Outstanding: 16.94B

Market Capitalization: $2.18T

Stock Price History

February 1, 2021 $134.14

February 2, 2021 $134.99

February 3, 2021 $133.94

February 4, 2021 $137.39

February 5, 2021 $136.76

0.205 Dividend

February 8, 2021 $136.91

February 9, 2021 $136.01

February 10, 2021 $135.39

February 11, 2021 $135.13

February 12, 2021 $135.37

February 16, 2021 $133.19

February 17, 2021 $130.84

February 18, 2021 $129.71

February 19, 2021 $129.87

Over the last week, shares of Apple, Inc. have fallen approximately 3.7% since trading opened Tuesday morning. After disclosure reports were released this week, it was announced that Berkshire Hathaway and Vanguard had trimmed their stakes in AAPL since the last report, decreasing their ownerships by 57.16 million and 25.51 million, respectively. Following the news, the company's stock fell below its 50-day moving average for the first time since November, leaving many investors wary. Apple's presence and power are undeniable with a customer base that few, if any, can compete with retention-wise, and with new innovation and pivots for the company on the horizon, the stock must be followed closely.

Ticker: MRK

Name: Merck & Co., Inc.

Number of Shares Outstanding: 2.53B

Market Capitalization: $189.02B

Stock Price History

February 1, 2021 $77.36

February 2, 2021 $77.77

February 3, 2021 $77.32

February 4, 2021 $76.03

February 5, 2021 $75.80

February 8, 2021 $75.04

February 9, 2021 $75.04

February 10, 2021 $74.89

February 11, 2021 $74.74

February 12, 2021 $75.00

February 16, 2021 $74.25

February 17, 2021 $75.54

February 18, 2021 $75.41

February 19, 2021 $74.31

Over the recent weeks, shares of Merck & Co., Inc. have faced a marked decline as the company demonstrated disappointing fourth-quarter and full-year earnings two weeks ago. With the pandemic impacting Q4 revenue by roughly $400 million and full-year revenues by nearly $2.5 billion, the share price faced a downward slide, one that was further accelerated by the company's reported diventure in Moderna, Inc. (MRNA). With a beta value of only 0.44, it is infrequent to see MRK shares face massive movement, leading an immediate return to its 2021 high of $85.00 to remain unlikely. However, Merck still serves as a foundational pillar of the pharmaceutical industry, one whose moves should be closely followed, particularly in relation to other biotech, drug, and life science firms.

Ticker: TTWO

Name: Take-Two Interactive Software, Inc.

Number of Shares Outstanding: 115,18M*

Market Capitalization: $22.44B

Stock Price History

February 1, 2021 $200.94

February 2, 2021 $207.11

February 3, 2021 $202.40

February 4, 2021 $201.49

February 5, 2021 $207.49

February 8, 2021 $213.34

February 9, 2021 $200.31

February 10, 2021 $199.82

February 11, 2021 $197.12

February 12, 2021 $199.86

February 16, 2021 $195.79

February 17, 2021 $195.93

February 18, 2021 $196.23

February 19, 2021 $194.86

Over the last week, Take-Two Interactive Software, Inc. (TTWO) saw further regression from their all-time high documented on February 8, as investors seemingly continued to pull capital after the record earnings report that Monday. That being said, the fundamentals of the company remain firmly grounded, presenting strong future upside. With their staple, open-world title Grand Theft Auto V surpassing 140 million copies sold this winter, 10 years after its initial release. This user base, along with the strong player engagement across other titles, allows Take-Two to sit as a digital media mogul at a fraction of the cost, given its $22.44B market cap. With such momentum generated by the Grand Theft Auto legacy title and its awaited successor, the recent release of next-generation consoles, and the ever growing and evolving world of interactive media, TTWO holds immense potential going forward.

Claire McKenna

Ticker: CSGP

Name: CoStar Group, Inc.

Number of Shares Outstanding: 39.42M

Market Capitalization: 32.579B

February 17: $910.75

February 18: $919.83

February 19: $913.00

February 22: $876.67

February 23: $866.98

February 24: $836.23

February 25: $820.00

February 26: $826.61

CoStar Group, Inc., is an industry leader in the technology and commercial property sector. CoStar’s five flagship brands including CoStar Suite, LoopNet, Apartments.com, BizBuySell, and LandsofAmerica. On Tuesday, February 23rd, CoStar Group reported earnings for the fourth quarter of 2020 and the year-end results. CoStar Group’s revenue for the year ended December 31, 2020 increased 19% year-over-year to $1.66 billion in comparison to $1.4 billion for the full year of 2019. This increase in revenue is higher than the predicted increase of 15.88% by analysts. Additionally, revenue for the fourth quarter also increased 19% to $444 million versus $375 million in the fourth quarter of 2019. Each of the five brands contributed to the overall improvement in revenue. However, Andrew C. Florence, Founder and Chief Executive Officer of CoStar Group, stated “I am particularly pleased that CoStar Suite had its best sales quarter of 2020 in the fourth quarter, more than doubling the third quarter sales level. Unique visitors to our marketplaces increased by over 20% for the year and by 29% in the fourth quarter as the pandemic led more people to shop for real estate online.” Consult the full report attached below for more details about the fourth quarter and full-year report.

John Paul Flores

Ticker: DASH

Name: DoorDash

Number of Shares Outstanding: 317.66M

Market Cap: 51.33B

Stock Price History

February 8, 2021 $183.45

February 9, 2021 $177.71

February 10, 2021 $190.66

February 11, 2021 $208.50

February 12, 2021 $213.03

February 16, 2021 $205.60

February 17, 2021 $213.82

February 18, 2021 $194.30

February 19, 2021 $200.07

February 22, 2021 $198.00

February 23, 2021 $175.97

February 24, 2021 $174.36

February 25, 2021 $174.41

February 26, 2021 $155.50

This week for DoorDash has been disappointing to say the least. After a strong second week in February the stock tanked. During the second week of February the company acquired a food robotics company called Chowbotics. This caused the stock to reach all time high around $220/share. In the week of the 22nd, the company was poised to post earnings on the 24th of February. During the earnings call it was discovered that although the sales grew by more than 226% the net loss more than doubled. The net loss totaled $316 million. There is something to be said about the over-valuation of DoorDash as a stock. It is no coincidence that the company IPO was released the same day the first vaccine was released. I think that this company is operating on too slim of margins in a highly competitive space. The outlook may be bleak, but there are some that look at DoorDash similar to Netflix in the early days. If DoorDash is able to capture more people for their subscription based service then they might be able to reverse course.

Jared Fenley

Ticker: EXAS

Name: Exact Sciences Corporation

Number of Shares Outstanding: 169.1M

Market Capitalization: $2.48

Exact Sciences is a leading cancer company developing tools for early detection, guidance, and monitoring. With a team of over 4,000 employees, including a 400 person R&D team, Exact Sciences develops technology for life science tools and integrated systems for large-scale analysis of genetic variation and function. The company’s leading product, Cologuard, is a non-invasive sDNA screening test for colorectal cancer, which is the leading cause of cancer death in the United States among nonsmokers. Using that sDNA, Cologuard can detect mutations in specific genes by purifying, amplifying, and detecting increased levels of methylation. Cologuard received FDA approval in August 2014, and along with OncotypeDX and OncotypeMAP, more than 4 million people have been tested by Exact Sciences products. The company aims to increase screening and early diagnosis of colorectal cancer, which would increase the survival rate to 90% if the disease is diagnosed early compared to the five-year survival rates of stages 3 and 4 at 71% and 14%, respectively. Utilizing resources from its acquisitions of Thrive Earlier Detection Corp., Base Genomics, and Genomic Health, Exact Sciences is currently developing a multi-cancer liquid biopsy screening test, with preliminary results of 86% sensitivity and 95% specificity in detecting six6 cancer types, that has the potential to revolutionize early cancer screening going forward.

Lexi Linafelter

Ticker: PYPL

Name: PayPal Holdings Inc.

Number of Shares Outstanding: 1.17B

Market Capitalization: $300.21 B

February 22, 2021 $273.85

February 23, 2021 $265.00

February 24, 2021 $266.07

February 25, 2021 $253.94

February 26, 2021 $252.94

February 27, 2021 $259.85

PayPal Holdings Inc. is an international financial technology and payment processing company headquartered in San Jose, California. Their payment solutions allow customers to both send and receive payments through a global, two-sided network that connects merchants and consumers with 305 million active accounts across more than 200 markets. While the stock price fell significantly from past weeks following PayPal’s 2020 earnings report, early last week, PayPal surpassed Mastercard in market value; PayPal shares were trading around $306 dollars with a $359 billion dollar market value, while Mastercard was trading around $341 dollars per share with a $339 billion dollar market value. This is likely in large part due to the fact that Mastercard as a major card processing network was hurt by the pandemic because overall payment volume, but (especially in-store) payment volume dramatically slowed down. Also this week, PayPal Partnered with CodeHouse, INROADS and National Association of Black Accountants to mentor and recruit black and diverse talent. This is intended to support PayPal's internal Diversity, Inclusion, Equity and Belonging programs and support the recruitment, hiring and career advancement of Black and underrepresented employees.

Hassan Ali

Ticker: CRM

Name: Salesforce

Number of Shares Outstanding: 917.73M

Market Cap: $212.07B

February 1, 2021 $228.46

February 2, 2021 $234.20

February 3, 2021 $234.82

February 4, 2021 $237.98

February 5, 2021 $238.89

February 8, 2021 $238.93

February 9, 2021 $236.70

February 10, 2021 $236.72

February 11, 2021 $241.24

February 12, 2021 $240.37

February 16, 2021 $248.59

February 17, 2021 $247.66

February 18, 2021 $247.01

February 19, 2021 $246.56

February 22, 2021 $240.95

February 23, 2021 $235.64

February 24, 2021 $240.47

February 25, 2021 $231.08

Salesforce is a software-as-a-service company based in San Francisco, California, and is the leader in the Customer Relationship Management (CRM) space with a market share of nearly 20%, more than double its closest competitor SAP at 8%. This week has been turbulent for the company ahead of its Q4 and FY2021 earnings report as share prices are down 4% on the week as of Thursday. On February 25, 2021 Salesforce had its Q4 and FY2021 earnings call where they recorded Q4 revenues of 5.82 billion, up 20 percent year over year and full year revenues of $21.25 billion up 24 percent year over year, exceeding analyst expectations. WIth regards to Salesforce's bottom line, Salesforce posted an EPS of $1.04 per share, adjusted, for the quarter, exceeding analyst estimates of 75 cents per share. A strong Q4 prompted Salesforce to raise its FY2022 revenue guidance by $200 million to $25.75 billion including $600 million from Slack. Their management believes that the pipeline is strong for their service offerings as the trend of companies digitizing their business model has been accelerated by the pandemic.

Sarah Korb

Ticker: SDGR

Name: Schrödinger

Number of Shares Outstanding: 56.32M

Market Cap: 7.267B

Stock Price History

February 1, 2021 $91.20

February 2, 2021 $93.99

February 3, 2021 $94.84

February 4, 2021 $98.49

February 5, 2021 $99.80

February 8, 2021 $100.00

February 9, 2021 $104.81

February 10, 2021 $105.46

February 11, 2021 $106.07

February 12, 2021 $108.49

February 16, 2021 $111.10

February 17, 2021 $109.61

February 18, 2021 $103.00

February 19, 2021 $102.00

February 22, 2021 $111.22

February 23, 2021 $106.70

February 24, 2021 $109.70

February 25, 2021 $111.40

Schrödinger Inc. is a life science and materials science company with a focus on developing state-of-the-art chemical simulation software for use in pharmaceutical, biotechnology, and materials research. Their physics-based software platform is transforming the way therapeutics and materials are discovered. This past week, Schrödinger’s market value reached an all-time high of $117.00 on February 22nd, 2021; this marks a growth of 154.62% from its original IPO value on February 26th, 2020. Despite this, the past week also showcased major pullbacks in Schrödinger’s market value given current market fluctuations and investors’ concerns over rising bond yields. Schrödinger announced that it expanded its partnership with Google cloud, increasing its original 3-year commitment (since 2019) to a 5-year commitment. As a result, Schrödinger will receive hundreds of millions of graphics processing unit (GPU) hours, effectively tripling their previous throughput and greatly expanding the power of their computational platform. This Friday, February 26th, Schrödinger is due to present at SVB Leerink’s Annual Global Healthcare Conference, which engages and showcases public companies, private companies, and industry experts that are shaping the future of healthcare.

Naia Morse

Ticker: ULTA

Name: Ulta Beauty, Inc.

Market Capitalization: 18.13B

Shares Outstanding: 56.34M

Stock Price History:

February 1, 2021 $282.03

February 2, 2021 $284.21

February 3, 2021 $287.83

February 4, 2021 $289.73

February 5, 2021 $297.90

February 8, 2021 $302.69

February 9, 2021 $314.59

February 10, 2021 $318.27

February 11, 2021 $315.65

February 12, 2021 $320.11

February 16, 2021 $319.82

February 17, 2021 $328.88

February 18, 2021 $321.79

February 19, 2021 $320.12

February 22, 2021 $314.02

February 23, 2021 $327.09

February 24, 2021 $326.05

February 25, 2021 $337.22

Ulta Beauty, Inc. (ULTA), the nation's largest beauty retailer, offers more than 25,000 products from approximately 500 well-established and emerging beauty brands across cosmetics, fragrance, skin care products, hair care products, and salon services. On February 4, 2021, the CEO of e.l.f. Beauty (a partner of Ulta Beauty), Tarang Amin, joined Yahoo Finance to discuss their third quarter fiscal year 2021 results, mentioning their sales in beauty grew 10% in a market that is down 20% for the year. He disclosed that they invested 15% of their net sales in marketing and digital (3% more than the previous year), as well as investing in the launch of Alicia Keys’ new skincare and wellness brand, Keys Soulcare, and acquiring W3LL People. This release yielded positive results for Ulta Beauty as demonstrated in their growing market value.

(https://finance.yahoo.com/video/e-l-f-beauty-ceo-170607379.html)

Megan Tao

Ticker: ETSY

Name: Etsy Inc

Number of Shares Outstanding: 126.09M

Market Capitalization: $24.91B

Stock Price History

February 1, 2021 $203.77

February 2, 2021 $210.07

February 3, 2021 $220.84

February 4, 2021 $231.12

February 5, 2021 $229.87

February 8, 2021 $225.65

February 9, 2021 $229.87

February 10, 2021 $225.65

February 11, 2021 $226.05

February 12, 2021 $233.86

February 16, 2021 $228.32

February 17, 2021 $222.41

February 18, 2021 $220.82

February 19, 2021 $227.27

February 22, 2021 $213.12

February 23, 2021 $210.75

February 24, 2021 $209.10

February 25, 2021 $197.58

February 26, 2021 $223.63

Etsy, Inc. operates online marketplaces where people around the world connect, both online and offline, to make, sell and buy goods. The company’s marketplaces include Etsy.com and Reverb.com, a marketplace for new, used, and vintage music instruments. While ecommerce is a competitive industry, Etsy distinguishes itself from other online marketplaces by selling “one of the kind” items that are custom and handmade. This past week, Etsy’s stock price steadily declined from $213.12 to $197.58. However, on Thursday, Etsy released its fourth quarter earnings and the stock looks to be heading on an upward trajectory as Etsy crushed Wall Street’s estimates, opening at $223.63 Friday morning. Earnings were reported at $1.08 per share vs. 59 cents per share expected, according to analysts surveyed by Refinitiv. Additionally, Etsy achieved revenues of $617.4 million, above the expected $516 million. Furthermore, the company added 61 million new and reactivated buyers to its platform and recorded nearly 160% growth in habitual buyers. Overall, Etsy reported healthy Q4 2020 results and it will be exciting to see how the company performs in 2021.

ON THE ROAD

—TO—

BLUE ROOM

IAN CARTER TRAVELING EAST FROM LA TO DENVER. THIS VIDEO TAKEN AT 11:29 MST 02 27 21.

We can BARELY CONTAIN OURSELVES as we await the arrival of analysts Ian Carter and Nick Peart as they relocate to Blue Room Denver HQ. Blue Room = Togetherism. Drive Safely!

10% OF ALL BLUE ROOM REVENUES GO DIRECTLY TO FUND OUR NON PROFIT TOGETHERISM.

WE CAN ACCOMPLISH ANYTHING TOGETHER.