Economic Charts

Economic Charts were first published on February 20, 2019. Last updated on July 9, 2019.

Disclaimer: I, Minyoung Sohn, claim the views expressed in the essay "Economic Charts" and the "Quarterly Update" series. These are original essays and the charts used in these essays were created by me using graphical editing tools in Bloomberg. The Quarterly Update does not necessarily reflect the views of my employer or any other organization, including, but not limited to Colorado Academy, MCA Denver or the Economic Club of Colorado.

Confidence is believing in yourself and having the ability to control your own destiny. It is the feeling of exhilaration while in pursuit of things hoped for. It is the ability to sustain one’s course of action.

U.S. is an Economy of You and Me

How We Work Together Creates Value

U.S. Labor Market — All Time Record

U.S. Employees on Nonfarm Payrolls — This monthly economic series has been tracked by the Bureau of Labor Statistics since 1939.

Total Unemployed Peaked at 15.3 million

Jobs provide self-realization for some; but for most, having a job means a paycheck for the most basic needs: food, clothing, shelter and entertainment. If you don't have a job, you don't have the means to provide for yourself or your family. It does not take long for hopelessness to set in and kill confidence. During the Great Recession, dubbed by the severity of the Financial Crisis, the number of unemployed Americans more than doubled from 7.2 million to 15.3 million.

Total Unemployed Reduced to 6.0 million

U.S. Unemployed Workers in the Labor Force. Unemployment measures the number of people who are not working, but are currently available to work and are looking for work. — This monthly economic series has been tracked by the Bureau of Labor Statistics since 1948.

Underemployment is Chronic and Overshadowed

There are 6 million Unemployed Americans, plus another 6 million Americans who are Underemployed

U-3 Unemployment Rate measures the unemployed as a percentage of the total labor force. The U-6 Unemployment Rate refers to underemployment and includes both part-time workers seeking full-time employment as well as workers who are overqualified for their current position. U-6 blew out to 17% during the Great Recession, but has improved significantly, approaching all-time lows. The U-6 monthly economic series has been tracked by the Bureau of Labor Statistics since 1994.

Record Job Openings

The availability of unfilled jobs—the job openings rate—is an important measure of the tightness of job markets, parallel to existing measures of unemployment. Started by the Department of Labor in December 2000, the Job Opening and Labor Turnover Survey ("JOLTS") is a monthly survey of specific job openings and vacancies conducted by The Bureau of Labor Statistics. JOLTS was created by the Department of Labor to serve as demand-side indicators of labor shortages at the national level. Prior to JOLTS, there was no economic indicator of the unmet demand for labor with which to assess the presence or extent of labor shortages in the United States.

CEO Confidence

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across corporate America, at organizations of all types and sizes, to compile our CEO Confidence Index data. Survey results are released each month on ChiefExecutive.net and reported on by TV and media outlets throughout the world.

Small Business Optimism

Started by the National Federation of Independent Business in October 1974, each month thegp surveys 800 small member companies.

The Source of Confidence (or Frustration) for the American Consumer

Statistically speaking, there has never been a better time to find a job. After the Financial Crisis, during the worst of the Great Recession, there were 15.3 million unemployed Americans and only 2.2 million job openings, a deficit of 13.1 million. According to the latest JOLTS report, there are 7.5 million jobs available, which is more than the 6.0 million unemployed Americans. Jobs are now searching for people, because there is a lack of skilled labor.

True Labor Supply (includes Potential Labor)

Two Built-In Shock Absorbers

Robotics and Artificial Intelligence Threaten Jobs Blue and White Collar Alike. Labor cannot make wage demands, because many routine tasks — manual labor, administrative or professional service — can be outsourced to cheaper labor or robotized through process automation.

The Labor Force Participation Rate is the total percentage of Americans who are working or seeking employment. This monthly economic series is from the Employment Situation which has been published by the Bureau of Labor Statistics since 1948.

Excessive Wages Will Increase Labor Supply Through Higher Participation

True Labor Supply includes Potential Labor. As measured by the U-3 Unemployment Rate, the Economy has run out of hourly labor, but there is still a surplus of available workers, those who could work if they wanted to, but choose not to. There are 4-6 million people who could enter the labor force if the job was right.

Investing in Job Skills Training Could Pay Big Economic Dividends

Published March 30, 2018. This update is a tribute to Bill Watterson, creator of Calvin and Hobbes. America's Middle Class has been shrinking after decades of dwindling income growth. So far in 2018, the U.S. Economy is showing signs of strength, and sustained consumer confidence could start a positive feedback loop in our service economy — but it is a delicate balance. I would become very bullish on signs of sustained growth in real wages. The wild card is the Trade War.

Wage Growth is Finally Picking Up

Is 4 Percent Possible?

Wage Growth Tracker measures the nominal wage growth of individuals. The Federal Reserve Bank of Atlanta calculates the median percentage change of hourly wages using microdata from the Current Population Survey, which is sponsored jointly by the U.S. Census Bureau and the Bureau of Labor Statistics. — This monthly economic series has been tracked by the Atlanta Fed since January 1997.

Average Hourly Earnings Confirm

Average Hourly Earnings measures the average hourly income earned across private sector jobs in the United States. — This monthly economic series has been tracked by the Federal Reserve Bank of St. Louis since March 1997. The St. Louis Fed calculates the percentage change of hourly earnings using data from the Current Employment Statistics survey, which is sponsored by the Bureau of Labor Statistics.

Employment Cost Index

The Employment Cost Index measures the total change in labor costs, including wages, bonuses and benefits such as training and health care. The Employment Cost Index is the key statistic from the quarterly National Compensation Survey, which has been conducted by the Bureau of Labor Statistics since the first quarter of 2001.

Average Weekly Hours

The labor shortage has created opportunities for working class Americans to add hours to their work week. Eight extra hours per week at $15 per hour produces $500 in additional monthly income, a 25% increase. This additional income is fueling growth in consumption of staples and other basics. During 2018, the average work week increased by 0.1 hours, even as employers added 2 million jobs. — This economic series has been tracked by the Bureau of Labor Statistics since 2006.

The U.S. Economy has a Strong Underlying Base

This article was published on LinkedIn, September 20, 2018. The U.S. working class is in its best shape since 2000. President Trump campaigned on an America First strategy, and in this moment of singular American economic strength, the Administration is demonstrating to its political base, in full theatrics, the resolve to fight to Make America Great Again, and neither friend nor foe be spared.

— Median Household Income —

The Paycheck finally picking up after years of stagnation

Let's put these wage gains in context. There is no excess here. The Middle Class got the wind knocked out of its sails during The New Normal. In 2007, households averaged $50,233 from total sources of income. From 2007 — 2014, household income grew by less than one percent annually to reach $53,657 (only 6.8% increase in seven years). Since 2016, with rising wage growth and strong weekly hours, median household income is growing again.

The Rent Check Keeps Rising

Since 2008, the average rent in the U.S. Metro area has increased by 40% from $974 per month to $1,371. From 2012 to 2018, rent increased on average by 4.4% per year. Recently, labor market data shows that average hourly earnings have been increasing at a rate of approximately 3—4%. However, wage gains continue to be outpaced the rate by increasing rent. Source: REIS Inc and Bloomberg. Reis is a data provider for the Commercial Real Estate industry.

The Importance of Confidence

Confidence is a “soft” data point with hard implications. A confident consumer foregoes saving, and the purchase of goods and the consumption of services today creates the demand for labor and employment in our service oriented economy. Savings, the discipline of putting away money now for investment creates capital for investment, but if we all save too much at the same time, we risk sliding into an economic stagnation called the paradox of thrift. With sustained confidence, the Real Economy of the United States can power economic growth to sustain prosperity at home while also boosting growth prospects around the world.

The Consumer Confidence Index — Since 1967, the Conference Board has conducted a monthly survey of 3,000 households measuring their feelings about current business conditions and their own job prospects. The survey asks respondents to gauge their Present Situation as well as their Future Expectations. Consumer Confidence peaked at 143 during the Internet Bubble. Interestingly, confidence made only a modest Housing Bubble high at 110 before the bottom fell out. The Financial Crisis destroyed jobs, and confidence cratered to 27, as the severity of the Great Recession, for a moment, also destroyed hope, the collective assessment of future expectations.

Presentation Situation as Strong as Ever

Since 1967, the Conference Board has been conducting a monthly survey of 3,000 households measuring their feelings about current business conditions and their own job prospects. The survey asks respondents to gauge their Present Situation and their Future Expectations.

Future Expectations

Since 1967, the Conference Board has been conducting a monthly survey of 3,000 households measuring their feelings about current business conditions and their own job prospects. The survey asks respondents to gauge their Present Situation and their Future Expectations.

Consumer Sentiment

The University of Michigan survey asks respondents to assess current business conditions and appraise their own income prospects. It is important to note that the survey also asks about future buying intentions. Each month, 500 individuals are randomly selected from the contiguous United States (48 states plus the District of Columbia) to participate in the Surveys of Consumers. The questions asked cover three broad areas of consumer confidence: personal finances, business conditions, and future buying plans.

Personal Savings

The decision to save, or spend, is critical for our Consumption-based economy

Since the Great Recession, Americans have boosted savings back to 6% of disposable income. First, cultural attitudes shifted after living through a tough economy. Conspicuous consumption may have been cool then, but you need a good credit score to get a date tonight. Second, Americans are working, but the economic disruption from the Trade War is an obvious risk to the current situation.

Confidence of Finding Work may not equal Confidence to Spend Wages

Retail Sales tracks the sale of goods to the public. After the Internet Bubble: In the month of September 2001, retail sales hit a cyclical bottom at 0.5% growth. There was no financial crisis following this bubble. After the Housing Bubble and Financial Crisis: Retail sales went negative in the month of October 2008 (-0.6%) then plunged, falling by -8.7% for the full year of 2009. — This monthly economic series has been tracked by the U.S. Census Bureau since January 1993.

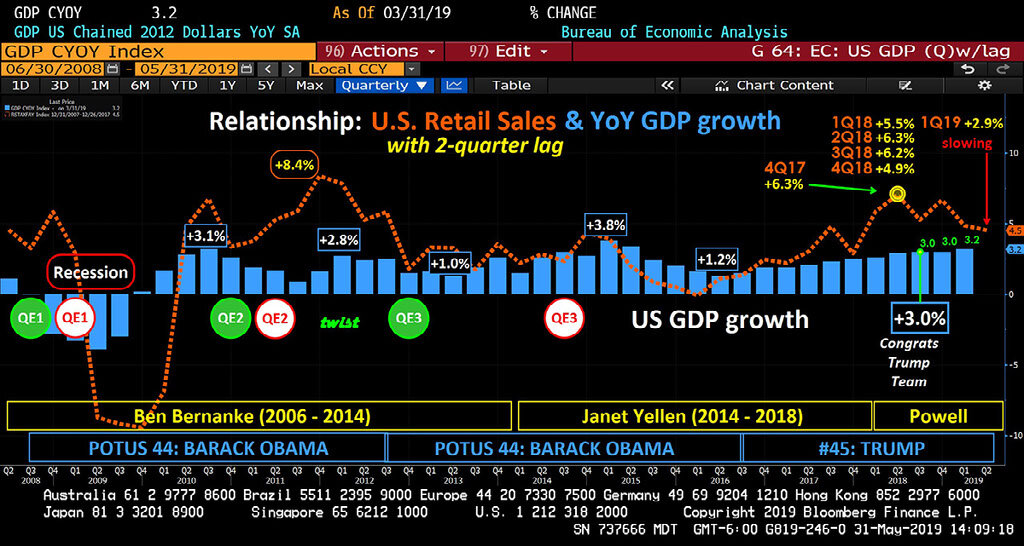

U.S. Real GDP Growth since 2008

To stimulate the economy, the Administration enacted tax reform and regulatory reform, classic supply side moves which boosted business confidence and job creation. During the President's first two years in office, real economic growth has accelerated to three percent, defying skeptics, many of whom resigned to believing that the lackluster growth of The New Normal had become a structural feature of developed economies.

Simple Economic Model

The Business Cycle is the way in which our economy expands and contracts over time. When a consumer makes a purchase today, the sale at the Cash Register triggers replenishment orders at the factory. In October 2018, the U.S. government reported continued strength in the economy, with real GDP increasing +3.0% versus the prior year. In recent months, retail sales growth has slowed from 6.7% in Q2 2018 to 4.8% in Q3 and 4.8% in Q4 2018. The current pace of retail sales suggests continued, but slowing, economic growth. A strong holiday season would support the domestic economic outlook in first half of 2019.

U.S. Retail Sales with a 2-quarter lag & GDP Growth

As of April 30, 2019

(A) U.S. Retail Sales are depicted in the orange dash line. (B) U.S. Real GDP growth is shown in the blue columns. Rising trends in retail sales growth coincides with stronger U.S. economic growth. In this graph, I shifted retail sales by two quarters (six months) to reflect how sales in the store lead to production in the factory. (A) In March 2018, U.S. Retail sales grew by 7.2%. (B) In Q3 2018, U.S. Real GDP grew by 3.0%. — (A1) In June 2018, U.S. Retail Sales grew by 4.8%. (A2) In September 2018, U.S. Retail Sales grew by 4.8%. (B1) In December 2018, U.S. GDP growth should be positive, but likely down slightly from Q3 2018, which grew by 3.0%. (B2) In March 2019, U.S. GDP growth should be similar to Q4 2018.

As of May 31, 2019

As of June 30, 2019

The Trade War

Published August 25, 2018. The United States Bull Market is now the longest lasting on record. Moreover, the strengthening U.S. economy is boosting the consumer and outlook for spending which will support economic growth.

A true win in The Trade War — China Opening up its vast Technology Market — would significantly increase future expectations and drive consumer sentiment, and the U.S. Economy

Real Improvement would Sustain the Bull Market

"China has implemented laws, policies, and practices and has taken actions related to intellectual property, innovation, and technology that may encourage or require the transfer of American technology and intellectual property to enterprises in China or that may otherwise negatively affect American economic interests. These laws, policies, practices, and actions may inhibit United States exports, deprive United States citizens of fair remuneration for their innovations, divert American jobs to workers in China, contribute to our trade deficit with China, and otherwise undermine American manufacturing, services, and innovation."

— Office of the U.S. Trade Representative

The American trade strategy is to divide and conquer by continent. First, NAFTA, then perhaps sweetheart deals for the United Kingdom and Australia, which would provide outposts into Europe and Asia, as well as the strategic encirclement of China. It's a gamble — But if the U.S. opens up China's consumer technology market, and the outcome is sustained improvement in the American economy, then it's four more years.

S&P 500

Dow Jones Industrial Average

Trade War Scoreboard

"We're Winning!"

Global stock market indexes hit their all-time high price on January 26, 2018. Through September 20, 2018, the Shanghai Composite had fallen by 25% whereas both the S&P 500 and Dow Jones Indexes were up for the year.

The Fed Takes Blame

The U.S. Economy was Breaking Out and Breaking Away from the Rest of the World, and the Fed was Normalizing Monetary Policy. All things equal, the Fed's action to raise interest rates results in a strengthening of the U.S. dollar which increases financial market volatility and pressures emerging markets.

On October 3, 2018, Federal Reserve Chairman Jay Powell appeared on PBS News Hour with Judy Woodruff — Chair Powell explained the critical importance of a politically-independent Fed "to do the right thing" and formulate good monetary policy for the good of the country. The markets interpreted his comments to be very hawkish, and asset prices corrected after this interview.

December 26, 2018

March 18, 2019

May 6, 2019

May 28, 2019

July 5, 2019

Entering 2019, the Federal Reserve faces a test of independence as it seeks to normalize interest rates and unwind the balance sheet.

Published December 31, 2018. The Fed is a remarkable institution with over 100 years of history, established by Act of Congress in 1913 to create a more safe and stable American monetary and financial system — the Fed’s credibility has underwritten global confidence in the United States dollar — the world’s reserve currency since 1973. On December 18, 2018, the Federal Reserve, in its first year under the leadership of Chair Powell, reaffirmed its commitment to serving the American people, outside of political pressure.

bit.ly/QuarterlyUpdateMainStreet

Federal Funds Rate

If the economy suffers from the Trade War, can the Fed pause, without also extending the Fed put?

20-Year History of U.S. Federal Funds Rate: How does easy monetary policy impact savers? Imagine having $100,000 of retirement savings in the bank – well done. For Americans of a prior generation, those savings would have earned $5,000 per year in safe, interest income.

Fed Funds Rate and the 30-Year Mortgage Rate

The Fed Funds Rate is in green. The Fed held down interest rates to zero percent for eight years under the Zero Interest Rate Policy. The impact of lower interest rates on borrowers is straightforward. Lower rates result in lower monthly payments. The 30-Year Mortgage Rate (red) bottomed at 3.32% on September 27, 2016, six weeks before the presidential election. The housing market is highly sensitive to interest rates.

Inflation, As Measured, Is Muted

The Federal Reserve believes that 2 percent inflation is most consistent with its long term policy objectives for full employment and price stability. Recent CPI data shows inflation trending at the Fed's target level.

The Consumer Price Index ("CPI") is measured inflation. CPI data is collected from 75 urban areas lacross 23,000 business establishments, and covers practically all of the major areas of consumer expenditures, including food and beverages, housing, clothing, transportation, medical care, recreation, education and communications. — The Consumer Price Index has been tracked by the Bureau of Labor Statistics since 1914.

Inflation, As Expected, Is Measured

The 5-Year, 5-Year (5Y5Y) is the market's guess for the 5-year outlook for inflation, 5 years in the future. From the series beginning of this series in 2004 until 2014, the market's implied inflation expectation ranged from 2.5%—3.2%. Inflation expectations fell to an all-time low during the New Normal, forcing the Fed to throttle back Lift-Off. — The embedded inflation expectation is calculated by subtracting the current 5-year inflation swap from the 10-year inflation swap.

The Trade War is Impacting Inflation Expectations

Quantitative easing was designed to create asset price inflation in hopes of boosting the consumer economy, but instead created dis-inflationary pressures which squeezed middle class incomes while also robbing savers and retirees of safe interest income. The financial markets, which benefited enormously from unconventional monetary policy, seeks both relief and an explanation. How can the Real Economy sustain growth in the face of rising interest rates and why is inflationary pressure dissipating? It’s the Trade War, stupid.

50-Year History of Inflation in the United States

The ability to control inflation at home is critical to maintain global confidence in the U.S. dollar which underpins the global financial system.

United States leadership in Energy is critical, because it allows us to better control the risk of runaway commodity price inflation as was experienced during the 1970s. Rampant inflation destroyed many economies around the world by undermining confidence. The Producer Price Index data measures the change in the price of goods as they leave the factory, or place of manufacture. PPI has been tracked by BLS since January 1974.

Published in December 2017. Game of Thrones reference is to idea that Normalization Is Coming. More on the Big Picture. The Greatest Bull Market in Bonds created a bull market in all asset classes and consumer net worth is at an all-time high. The Winter Update asked: “What happens when Federal Reserve begins the normalization of monetary policy?”

The 40-Year Secular Decline In Interest Rates is Ending

The 40-Year Secular Decline In Interest Rates is Ending. From 1962 to 1979, America's insistence on both Guns and Butter (Vietnam and Lyndon Johnson's Great Society) exposed our economic flanks to the Arab Oil Embargo, and two oil shocks culminated in a nasty period of Stagflation. Fed Chairman Paul Volcker earned his spot in history with his decisive victory against inflation. In 1981, the yield on the U.S. 10-Year Bond set its generational high at 16%, and has since declined to 3%.

To calm the Financial Crisis, The Fed and the United States Treasury led rescue efforts. The Treasury provided immediate relief with Bailout capital, to both Wall Street and Detroit. The Federal Reserve responded by implementing Ben Bernanke's Helicopter Money philosophy of the Zero Interest Rate Policy. Under Bernanke, the Fed lowered the Fed Funds rate to 0%. The Fed also purchased nearly $2 trillion of U.S. Government Bonds as well as nearly $2 trillion of Fannie Mae and Freddie Mac mortgage bonds from Wall Street.

Federal Reserve Balance Sheet, Securities Held Outright. Quantitative Easing (QE) is represented by the little green pills in these graphics. Before 2008, the Federal Reserve balance sheet was a $755 billion, with the securities portfolio invested entirely in U.S. Treasuries. In 2017, the Fed began to communicate its intent to "normalize" its balance sheet.

The U.S. Dollar Index is the trade-weighted basket of major foreign currencies. The Canadian Dollar is 12% of the Dollar Index. The Japanese Yen makes up another 12%. The remaining ~75% is comprised of the Euro and other European currencies. In Red, the U.S. Dollar Index which peaked at 151 in 1984 and hit another high at 119 in 2001. In white, the U.S. 10-Year Treasury Yield over the same time period.

Published June 30, 2018. The World Cup Update — The Great Power Games. The Korea Update: Nothing. President Xi could help denuclearize the Korean peninsula, but why bother until there is a resolution to the Trade War? The U.S. economy is breaking away from the rest of the world, by posting 2.8% GDP growth in Q2 2018. For the first time, there are more job openings than unemployed Americans. Meanwhile, the Fed is planning to Normalize its balance sheet later this year.

#Helsinki2018 The Helsinki Summit, July 16, 2018. The 2018 World Cup was held in Russia from 14 June to 15 July 2018.

Will the United States stay on top?

Since the Election of 2016, the U.S. Economy has continued to improve each quarter, with Real GDP growth hitting 3.0% in the third quarter of 2018. Three percent real GDP growth is a credit to the Trump economic team.

Since the Election of 2016, the U.S. Economy has continued to improve each quarter, with Real GDP growth hitting 3.0% in the third quarter of 2018. Three percent real GDP growth is a credit to the Trump economic team.

Economic growth by decade (average) in 1970s 3 percent — 1980s 3 percent (averaged 4.4% from 1983 to 1989) — 1990s 3 percent — 2000s 2 percent — 2010s 2 percent ("The New Normal" declared)

Federal Budget in Absolute Dollars

Federal Budget as a Percentage of GDP

Dollar Standard for the World — The Fed's Credibility is Critical for Expansionary American Policies. By the end of 1991, U.S. public debt totaled over four trillion dollars and was 62% of GDP, the highest level of indebtedness for the United States since the Bretton Woods II Agreement. With the end of the Cold War, the dollar, which was the reserve currency for the First World, became the reserve currency for an entire global system moving into an American world order based on liberal democracy and free market economies, and the perpetual demand for U.S. dollars provides unconstrained financial resources for so long as the dollar is viewed to be as good as gold. The United States dollar is essential to sustaining America's Unipolar Moment.

In 1982, the Federal Reserve, led by Paul Volcker, beat inflation, which earned credibility for United States dollar as a safe store of value. After the End of the Cold War, the dollar became the world's reserve currency.

In 1981, the U.S. 10-Year Treasury hit its generational high yield of 16% as Fed Chairman Paul Volcker tightened U.S. monetary policy to whip inflation. Falling interest rates boost asset prices (in all asset classes: stocks, bonds, real estate, etc.) through the discounting mechanism. By mathematical extension, zero interest rates would act as NOS (nitrous oxide system, a la Fast & the Furious).

Published April 18, 2018. Special Trade War Update | Act II. China, Retaliation and Return to Tian Xia. China was the world's original superpower, China boasted unrivaled economic power and cultural influence, for most of recorded history. However, China's dominance was disrupted by superior Western military technology during the Opium Wars of the 19th century. What does China want? — Respect and a return to global leadership.

The Savings Rate (American Consumer)

Personal Savings. In my opinion, Economic analysis should start with an understanding of what motivates Americans to save. Savings creates capital, but it is spending that drives the economy. From 1998 to 2008, Americans cut their savings in half for a decade, enjoying the asset price inflation of the Internet Bubble and the Housing Bubble. However, since the Great Recession, Americans have boosted savings back to 6% of disposable income. Conspicuous consumption may have been cool then, but you need a good credit score to get a date tonight.

U.S. Manufacturing Jobs (The U.S. President)

Millions of Americans lost good manufacturing jobs after NAFTA. From 1992 to 2016, three different administrations, Bill Clinton, George W. Bush and Barack Obama, continued the economic and trade policies which came at the expense of the middle class. Either, the experts were wrong, or they deliberately sacrificed the American jobs in the name of globalization. The middle class experience with globalization exposed populist political vulnerability for both Democrats and Republicans.

Implied Volatility (Equity Market)

Yield Curve (Bond Market)

Emerging Markets vs. the U.S. Dollar

Bitcoin (Speculative Appetite, Despair Meter)

Last update (September 10, 2018) = 17.3 million bitcoins in circulation. Only 21 million bitcoins will

Gold (Confidence in the U.S. Dollar & the Federal Reserve)

How International Confidence Impacts the Dollar

(The President provides personal attention to the leaders of these dollar customers)

Foreign Owners of U.S. Treasury Bonds (China's Confidence in the U.S. Dollar)

China Foreign Exchange Reserves. In July 2010, China became first country in the world to accumulate $1 trillion in U.S. Treasury bonds.

Foreign Owners of U.S. Treasury Bonds (Japan's Confidence in the U.S. Dollar)

The U.S. dollar is the primary reserve currency held by Japan. Since joining the One Trillion Dollar Club in October 2011, the Japanese holdings of U.S. Treasuries has never dipped below $1,000,000,000,000.

Published February 7, 2019. Mr. President, we all want to be part of an American winning team. But *how you communicate — not just what you say, but what you don't say — makes all of the difference in the world. The State of the Union is an Annual Update made by the President to a joint session of Congress, as prescribed by Article II, Section III of the U.S. Constitution. This edition of the Quarterly Update studied the speech and included an Open Letter to the President.

Insanity is doing the same thing over and over again.