2018 Review & 2019 Outlook

The Fed is a remarkable institution with over 100 years of history, established by Act of Congress in 1913 to create a more safe and stable American monetary and financial system — the Fed’s credibility has underwritten global confidence in the United States dollar — the world’s reserve currency. On December 18, 2018, the Federal Reserve, in its first year under the leadership of Chairman Jerome Powell, reaffirmed its commitment to serving the American people, outside of political pressure. (In 1997, I was an intern for Mr. Steve Rhoades in the Financial Structure Section of the Federal Reserve Board of Governors in Washington, D.C.)

The Quarterly Update series was created to demystify Economics and Investing: First published on March 30, 2017 and last updated: December 31, 2018

China was the world's original superpower, circa 2100 BC — 1839 AD

"At its ultimate extent, the Chinese cultural sphere stretched over a continental area much larger than any European state, indeed about the size of continental Europe. Chinese language and culture, and the Emperor's political writ, expanded to every known terrain: from the steppelands and pine forests in the north shading Siberia, to the tropical jungles and terraced rice farms in the south; from the east coast with its canals, ports, and fishing villages, to the stark deserts of Central Asia and the ice-capped peaks of the Himalayan frontier. The extent and variety of this territory bolstered the sense that China was a world unto itself. It supported a conception of the Emperor as a figure of universal consequence, presiding over tian xia, or "All Under Heaven." (from On China by Henry Kissinger)

America's Growing Military and Economic Power

Technology Leadership and Energy Primacy Won Victory in World War II

In the years before Japan bombed Pearl Harbor, the U.S. spent less than 2% of GDP on defense. On December 8, 1941, the United States Congress declared war against the Axis Powers, and the entire American civilian population was mobilized to win what scholars called a "total war." By 1945, defense spending in the U.S. increased to 36% of gross domestic product. From 1941 to 1945, the war consumed one-third of total American economic output, totaling $249 billion in those years. In today's dollars, a total war of similar magnitude would cost $20 trillion.

— Coming out of the Oil Shocks and Stagflation of the 1970s —

First World

During the Cold War, the United States provided military, economic and political leadership to a Western Bloc of nations rooted in liberal democracy called the First World. In 1980, America elected Ronald Reagan, who espoused a suite of unconventional and highly expansionary fiscal policies called Reaganomics. First, Reagan reduced government interference in personal life and in private business. Second, The Economic Recovery Tax Act of 1981 significantly lowered federal income taxes across the board. These were classic supply-side boosts to increase the production of goods (create disinflation) as well as increase the factory employment of workers (the trickle down benefit promised by supply-side economists).

In 1981, Reagan's first year in office, the United States increased defense spending by 17% to $158 billion, to 5.0% of GDP. During Reagan's eight years in office, defense spending totaled over $3 trillion dollars. In 1983, Ronald Reagan revealed “Star Wars,” or the Strategic Defense Initiative, a revolutionary missile defense system which would equip satellites with lasers and railguns to shoot down Soviet ballistic missiles.

Voodoo Economics. From America's founding until 1981, the United States had accumulated less than one trillion dollars in total public debt. Reagan's supply side policies stimulated economic growth, but the tax cuts resulted in substantial revenue shortfalls. Additionally, the Reagan Administration was inciting an Arms Race with the Soviet Union, as the United States doubled down on defense spending during Reagan's time in office.

Better Together: Expansionary Fiscal Policy and Fed Credibility

Reaganomics produced massive budget deficits which required noninflationary monetary policy to defend the dollar. From 1980 to 1982, the Federal Reserve led by Paul Volcker, fought and beat inflation by raising short term interest rates as high as 20% to choke off cost pressure lingering from the 1970's oil shocks. The decision to tighten monetary policy, initially painful and contractionary, planted the seeds of credibility for the Federal Reserve and the United States dollar to be as good as gold in the expansionary American economic ecosystem. After suffering from stagflation in the 1970s, U.S. economic growth averaged 4.9% from 1982 to 1987.

Second World

During the Cold War, the Union of Soviet Socialist Republics (U.S.S.R.) led an Eastern Bloc of nations industrializing under centralized planning principles rooted in Marxism—Leninism. This vast sphere of influence encompassed the satellite states of Central and Eastern Europe, and extended far east to Mao Zedong's Communist China. We called this the Second World.

The Iron Curtain was a physical border of satellite states of the Eastern Bloc providing a buffer for the U.S.S.R. versus Western Europe. The Soviet sphere of influence included East Germany, Czechoslovakia, Hungary, Romania, Yugoslavia, Bulgaria and Albania. Glasnost rekindled nationalist sentiment across the Soviet system, including in Hungary, a satellite state by territorial annexation, later re-invaded by the U.S.S.R. to crush the Hungarian Revolution of 1956, a student-led call for self determination. In the summer of 1989, the Hungarian government removed the electric fence which separated Austria from Hungary (from 1867—1917, the Austria—Hungarian Empire was a dual monarchy, united by constitutional agreement for mutual benefit and defense in international affairs). With this crack in the Iron Curtain, thousands of East Germans flowed to the West.

Technology Gap

The geopolitical rivalry between the First and Second World was intense, replete with the traditional showcasing of military power across land, sea and air, but the competition for influence and global superiority moved even to the frontiers of technology and space. In 1957, the Soviet Union was first to space with Sputnik, which triggered John F. Kennedy’s challenge that the United States be first to the moon in 1969 (the Soviets never made it up there). In 1975, Apollo—Soyuz was a demonstration of the kinship of humanity, as American and Soviet astronauts linked up in space, but America was pushing ahead in technology and economic development.

M.A.D. — The Only Defense Against Nuclear Attack. — No nuclear weapon has been used in warfare since the United States devastated Hiroshima and Nagasaki in 1945. During the Cold War, both the U.S. and the Soviet Union relied on a deterrence strategy called Mutually Assured Destruction for national security. Each stockpiled enough nuclear weapons to guarantee that any first strike would be met by a sufficient nuclear counterstrike that would result in the mutual destruction of the other, and likely the world.

In 1983, Ronald Reagan revealed “Star Wars,” or the Strategic Defense Initiative, a revolutionary missile defense system which would equip satellites with lasers to shoot down Soviet ballistic missiles. If successfully developed, Star Wars would create an enormous strategic vulnerability for the Soviet Union, by creating First Strike capability against the U.S.S.R. — if the United States fired first, the Soviet nuclear counterstrike would be intercepted by the U.S. missile defense shield, a nuclear umbrella. For the Soviet Union, Star Wars meant the loss of second strike capability and any sense of security under M.A.D. or mutually assured destruction.

Soviet Union Long Range Strategic Goal for 2000

The Era of Stagnation. Leonid Brezhnev succeeded Nikita Khrushchev in 1964 and led the Soviet Union until his passing in 1982, at 75 years of age. Yuri Andropov succeeded Brezhnev until his passing in 1984, at 79 years. Konstantin Chernenko succeeded Andropov until his passing in 1985, at 73 years. On March 11, 1985, the Politburo of the Community Party selected Mikhail Gorbachev, its youngest member at 54 years, to become Secretary General, transitioning away from gerontocracy. Early in his career, Gorbachev distinguished himself for exhibiting efficiency, reliability and humility in his administration outpost, and his earnestness and loyalty secured his career advancement within the communist party. As the new leader of the Soviet Union, Mikhail Gorbachev set out to reverse the economic stagnation of the Brezhnev era and accelerate economic growth required to match the United States by 2000.

/ Chernobyl Blows Up \

On April 25–26, 1986, the Chernobyl nuclear power plant experienced a catastrophic failure when an explosion during a safety test, caused by faulty design and haphazard operating procedures, initiated a meltdown. The Soviet Union was forced to admit to the world that it had a nuclear accident, and for many days, the global news media covered the local evacuation and exposed the lasting effects of global fallout. The devastation of Chernobyl prompted Gorbachev to shock the world by announcing new policies of glasnost or “openness” to talk about problems in the Soviet system and perestroika to suggest better ways to do things.

Fall of Communism and Disintegration of the Soviet Union

The U.S.S.R., dominated by Russia, was a political union of 15 disparate states, rich in cultural heterogeneity and spanning eleven time zones held together by and tightly controlled by the one-party Communist system under Marxism—Leninism philosophy. To save the Communist Party, Secretary General Mikhail Gorbachev implemented political reforms but burgeoning cracks (encouraged by glasnost) and fewer crackdowns (resulting from perestroika) unleashed nationalist sentiment for self-determination across the Soviet system.

The Baltic States of Estonia, Latvia and Lithuania, which had always maintained strong national self-identity throughout the Soviet occupation, pushed for independence. Soviet states in the Caucasus region in Central and Eastern Europe fell into civil war, and Russia itself broke for self identity. In 1991, the last legislative act of the Supreme Soviet of the Soviet Union, the highest authoritative legislative body, Declaration 142—H dissolved the U.S.S.R. into the Commonwealth of Independent States.

America’s Unipolar Moment

circa 1991 — ?

In 1982, the Federal Reserve, led by Paul Volcker, beat inflation, which earned credibility for United States dollar as a safe store of value. After the End of the Cold War, the dollar became the world's reserve currency.

U.S. Grand Strategy after the Fall of the Soviet Union

Grand Strategy of Containment. During the Cold War, America's grand strategy was to contain the spread of Communism around the world. After the fall of the Soviet Union, the United States was the sole superpower in the world, and the Iraq War in 1990—91, demonstrated the full capability of the United States military power, enhanced by allied support and coordination.

Grand Strategy of Preponderance. In 1992, leaked documents to the New York Times revealed America's new grand strategy, Preponderance. The United States aimed to maintain its status as the sole global superpower, for as long as feasible, by redirecting hard military spending to the development of international apparatuses designed to strengthen America's position in each major theater of the world, North America, Europe, the Middle East and East Asia and thereby contain the rise of competing powers.

During the Cold War, the United States devoted significant resources to contain communism, including stationing nearly 400,000 troops in Europe to deter a Soviet-led invasion against NATO. The dissolution of the Soviet Union reduced America's need to maintain costly conventional military deployments around the world. (source of graphic, right-side: Denise Lu, the Washington Post, July 12, 2018)

Defense Planning Guidance, FY 1994-1999 (February 29, 1992)

Defense Planning Guidance, FY 1994-1999 (April 16, 1992)

Neorealism (strategy formerly known as Realpolitik) & the Unipolar Illusion

Political scientist Christopher Layne argued that a strategy of preponderance would exhaust America’s economic resources in a self-defeating Imperial overreach to maintain global dominance against a growing coalition of challenger countries. The United States was enjoying a Unipolar Moment, which was inherently unstable.

Dollar Standard for the World — The Fed's Credibility is Critical for Expansionary American Policies. By the end of 1991, U.S. public debt totaled over four trillion dollars and was 62% of GDP, the highest level of indebtedness for the United States since the Bretton Woods II Agreement. With the end of the Cold War, the dollar, which was the reserve currency for the First World, became the reserve currency for an entire global system moving into an American world order based on liberal democracy and free market economies, and the perpetual demand for U.S. dollars provides unconstrained financial resources for so long as the dollar is viewed to be as good as gold. The United States dollar is essential to sustaining America's Unipolar Moment.

NAFTA

U.S. Trade Liberalization with Mexico

The Fall of the Berlin Wall ushered in West Germany's Reunification with East Germany and set the stage for broader European integration including common markets, the Euro and the European Union.

In North America, President George H. W. Bush advanced the North America Free Trade Agreement. The Bush Administration desired to foster the development of Mexico's economy and democratic institutions to promote a stable security environment in Latin America and the Caribbean, as well as prevent illegal drugs from entering the United States.

Published December 7, 2018. I am bullish on the future of U.S. — Mexico relations in this Global Wave of Regionalism. Mexico is an abundant land, richly endowed with natural resources and blessed young human capital. Those with business know-how can create valuable companies, over time, with continuous investment in the people of Mexico.

“Economic History of Mexico and the United States” published November 2018

The Giant Sucking Sound

In the 1992 presidential election, third party candidate Ross Perot warned about losing American jobs to cheap Mexican labor. In 1994, south of the border, political unrest and pump priming of the economy in an election year triggered the Tequila Crisis and the collapse of the Mexican peso within the first year of NAFTA. Maquiladoras, assembly factories created for NAFTA—compliant exports flourished. Manufacturing jobs in the United States, which averaged 17.8 million (1969–1993) declined to 11.5 million by 2009.

Economic Liberalization — NAFTA and China’s entry into the World Trade Organization — suppressed U.S. economic growth during the recovery and contributed to The New Normal

The New Normal

The Great Recession ended in 2009, but the pace of economic recovery was so slow, stuck at 2 percent for so long that the concept of The New Normal, coined by Mohamed El-Erian, became commonly used in our daily conversation. The New Normal sucked the life out of middle America, and American politics were upended in the Election of 2016.

Donald Trump pulled off one of the greatest political upsets in modern history. As a Populist candidate, "Businessman" and Reality TV star Donald Trump beat Hillary Clinton. The Trump Era marks the end of linearity as the Administration is reversing our nation's previous strategy of globalization and trade liberalization.

"The Case for Active Investing", published in November 2016

In 2017, the Trump administration advanced Deregulation and Tax Reform, supply side economic policies which increased business confidence and the optimism of American CEOs. Companies boosted spending and capital investment, and more Americans returned to work, resulting in a positive feedback loop in our service economy. — It was a whiff of Animal Spirits of cycles past.

The Trade War

Risking Post-Election Strength

President Trump campaigned on an American First platform, and in this moment of singular American economic strength, the Administration is demonstrating to its political base, in full theatrics, the resolve to fight to Make America Great Again, and neither friend nor foe be spared.

Global stock market indexes hit their all-time high price on January 26, 2018. Through September 28, 2018, the Shanghai Composite had fallen by 20% compared to only a 1% decline in the Dow Jones.

On January 22, 2018, the United States opened the Trade War with China by implementing import tariffs. The Trump administration confronted the Chinese government regarding unfair trade practices, including the unequal access to markets, the protection of intellectual property rights, and the forced transfer of technology. I have written on the Trade War and these reports can be read using the links below.

Special Trade War Update I: What America Wants (dated March 30, 2018)

Special Trade War Update II: What China Wants (dated April 18, 2018)

On December 17, 2018, Peter Navarro, Special Assistant to the President for Trade and Industrial Policy, articulated the Administration's position on the Fed's normalization of monetary policy. Mr. Navarro said the Fed should "look at the data", (1) pause interest rate increases and (2) pause the reduction of the balance sheet

Full CNBC Interview of Peter Navarro

Protecting the Technology Gap

"China has implemented laws, policies, and practices and has taken actions related to intellectual property, innovation, and technology that may encourage or require the transfer of American technology and intellectual property to enterprises in China or that may otherwise negatively affect American economic interests. These laws, policies, practices, and actions may inhibit United States exports, deprive United States citizens of fair remuneration for their innovations, divert American jobs to workers in China, contribute to our trade deficit with China, and otherwise undermine American manufacturing, services, and innovation."

U.S. Trade Representative, Section 301

The Situation

Political Independence of the Federal Reserve

The U.S. Economy is Breaking Out and Breaking Away from the Rest of the World, and the Fed is Normalizing Monetary Policy. All things equal, the Fed's action to raise interest rates results in a strengthening of the U.S. dollar which increases financial market volatility and pressures emerging markets.

Global stock market indexes are plunging as the Trade War drags on, but the Fed is also taking blame. As of December 26, 2018, the Shanghai Composite is down 30% from its all-time high price on January 26, 2018. In recent weeks, the U.S. stock markets have corrected sharply and have fallen into Bear market territory, despite the strong real economy.

"It is incredible that with a very strong dollar and virtually no inflation, the outside world blowing up around us, Paris is burning and China way down, the Fed is even considering yet another rate hike. Take the Victory!" — Donald Trump, Tweet 12/17/18

"I hope the people over at the Fed will read today's Wall Street Journal Editorial before they make yet another mistake. Also, don't let the market become any more illiquid than it already is. Stop with the 50 B's. Feel the market, don't just go by meaningless numbers. Good luck!" — Donald Trump, Tweet 12/18/18

Federal Reserve Chair Jay Powell explains the critical importance of being removed from the political process, trying to do the right thing and formulate good monetary policy for the good of the country. (this moment starts 9 minutes into the interview)

PBS News Hour with Judy Woodruff on October 3, 2018

United States 10-Year Treasury Yield

The 40-Year Secular Decline In Interest Rates is Ending

From 1962 to 1979, America's insistence on both Guns and Butter (Vietnam and Lyndon Johnson's Great Society) exposed our economic flanks to the Arab Oil Embargo, and two oil shocks culminated in a nasty period of Stagflation. Fed Chairman Paul Volcker earned his spot in history with his decisive victory against inflation. In 1981, the yield on the U.S. 10-Year Bond set its generational high at 16%, and has since declined to 3%. Most investors are virgins when it comes to rising interest rates.

Interest Rate Normalization

In 2008, the Federal Reserve, led by Chairman Ben Bernanke, cut interest rates to zero percent — and held them there — for eight years. In 2016, the Federal Reserve, led by Chair Janet Yellen, started Lift-Off. In 2018, the Federal Reserve, led by Chairman Jerome Powell, continued the process of raising the Fed Funds rate toward neutral.

The U.S. Federal Funds Rate (also called "Fed Funds") is the interest rate at which Banks lend each other money on an overnight basis. The Fed Funds Rates is set by the Federal Open Markets Committee of the Federal Reserve (the "FOMC") and Fed Funds is a key determinant of the ultimate cost of borrowing for both Companies and Consumers.

Imagine having $100,000 in the bank. Until the bursting of the Housing Bubble, every $100,000 in savings yielded $5,000 to $6,000 in interest income. If you worked hard enough, or were lucky enough, to have one Million dollars, risk free investments returned $50,000 — approximately the median household income. For savers, interest rate normalization means livable income on certificates of deposit.

During Quantitative Easing, the Fed injected $5 billion per day into the markets. During Quantitative Tightening, the Fed is allowing QE to roll off by approximately $2 billion per day.

Quantitative Tightening

QE3 was completed in 2014, but the Fed maintained the size of its expanded balance sheet by reinvesting the proceeds from the bonds that reached maturity each month. In November 2018, the Fed stopped reinvestment, to allow these bonds to roll of the balance sheet, at an approximate rate of $2 billion per day, or $50 billion per month.

Federal Reserve Balance Sheet, Securities Held Outright. Quantitative Easing (QE) is represented by the little green pills in these graphics. From 2009 to 2014, the Fed “printed money,” $3.5 trillion in three dosages, to lower interest rates to zero percent. Before 2008, the Federal Reserve balance sheet was a $755 billion, with the securities portfolio invested entirely in U.S. Treasuries. In 2017, the Fed began to communicate its intent to "normalize" its balance sheet.

How Interest Rates Impact Main Street

On a cash flow basis, the Federal Reserve's interest rate normalization may improve monthly cash flow for many Americans who live on Main Street

The Fed Funds Rate is in green. The Fed held down interest rates to zero percent for eight years under the Zero Interest Rate Policy. The 30-Year Mortgage Rate (red) bottomed at 3.32% on September 27, 2016, six weeks before the presidential election.

Financing a home purchase will become more expensive. Home prices, as measured by the Case-Shiller Index have returned to cyclical highs. — The consumer is showing restraint, and the housing is slowing down despite a strong jobs market and tight housing supply. Mortgage rates bottomed in 2016. Since then, the 1.5% increase in the 30-year mortgage rate has increased monthly payments by approximately 20%.

Compared to The New Normal, the Next Five Years. The 30-year mortgage rate hit 3.3% in 2016 and has since risen to 4.75%, an increase of almost 1.5 percent. With the Fed's tightening cycle, from 2019 to 2023, every $100,000 in a 30-year mortgage, will result in additional $5,400 in total monthly payments ($90 increase for 60 months).

Risk free investments such as certificates of deposit will yield real interest income for savers and retirees — and institutional investors. In 2016, a five-year certificate of deposit paid less than one percent. Today, it’s three percent and climbing.

Compared to The New Normal, the Next Five Years. In 2016, during the Zero Interest Rate Policy, a 5-year certificate of deposit paid less than 1% interest. Today, a 5-year certificate of deposit offers 3.15%. From 2019 to 2023, every $100,000 invested a FDIC-guaranteed certificate of deposit earns an additional $11,674 in total interest.

The Stock Market

An Asset Bubble Created by Quantitative Easing?

The Dow Jones Industrial Average hit 22,000 — a new record high — on August 2, 2017. For the year, the S&P 500 gained over 20% in 2017 and during the year, the benchmark average never had a one percent daily decline.

The President’s preferred stock market index, the Dow Jones Industrial Average peaked on January 26, 2018 at $26,616.

How Interest Rates Impact Wall Street

The Greatest Bull Market in Bonds Fueled Bull Markets in all Asset Classes

Falling interest rates boost asset prices (in all asset classes: stocks, bonds, real estate) through the discounting mechanism. By mathematical application, zero interest rates would act as NOS (nitrous oxide system, a la Fast & the Furious) to asset valuations.

The S&P 500 made its all-time high on September 20, 2018 at 2,930. The 10-Year U.S. Treasury Yield made its all-time low of 1.36% on July 8, 2016.

Quantitative Easing Illustrated

QE focuses on the asset side of the consumer balance sheet. The theory was that asset price inflation would create a wealth effect which would nudge Americans to increase spending to drive economic growth (consumption is two-thirds of the U.S. economy).

Four Trillion Dollars of QE Created Asset Price Inflation but the trend in U.S. Nominal GDP Did Not Change — The U.S. Economy Remained Stuck in The New Normal

In Grant's Interest Rate Observer, Founder and Editor Jim Grant argued that Quantitative Easing was boosting U.S. Consumer Net Worth well ahead of U.S. Nominal GDP growth. To reinforce his point, I created this illustration by embellishing the economic chart from Evercore ISI.

(1) Helicopter Money: An Analysis of Quantitative Easing, last updated on March 2017

Helicopter Money Illustrated

QE produced asset price inflation but failed to stimulate consumer spending or boost the Real Economy. Arguably, QE produced disinflationary forces in two ways. First, the hunt for income yielding assets contributed to rapidly rising apartment rental rates which squeezed working class Americans still earning stagnant real wages. Second, the loss of interest income ZIRP-ed the purchasing power of savers and retirees. Main Street is a resilient constituency — all that is needed is a reason for Optimism.

(2) Helicopter Hope: An Unconventional Play for Unconventional Times, published November 2, 2016

Since 2000, Two Asset Price Bubbles Created Two Recessions

During the Internet Boom, many households saw their stock portfolios zoom to values previously unimaginable. In 2001, the bursting of the Internet Bubble and the 9/11 terrorist attacks pushed the U.S. economy into a mild recession.

During the Housing Boom, homeowners, bank lenders and professional investors all believed that housing prices would rise forever, and millions of Americans took equity out of their homes to finance consumption. In 2007–8, the Housing Bubble burst, creating a severe Financial Crisis which led to the Great Recession. The fear of systemic collapse mandated unconventional monetary policy but the subdued economic recovery called The New Normal pressured the Fed to press bets on a consumer wealth effect which never materialized.

Entering 2019, the world is watching and reading the commitment of the Federal Reserve to normalize interest rate policy and unwind two trillion dollars from the balance sheet.

Restoring the Right Balance

Published April 2018, in tribute to Bill Watterson, the creator of Calvin and Hobbes. The Fools update noted that — to sustain improvement in the U.S. consumer economy — balance is key.

The Fed is unwinding unconventional monetary policy. The Zero Interest Rate Policy and Quantitative Easing averted worsening of the Financial Crisis. However, asset price inflation from the accommodative monetary boost failed to stimulate the real economy. So, is it possible that the Fed's normalization of monetary policy will not harm the real economy, even if it deflates the stock market?

The Real Economy

This article was published on LinkedIn, September 20, 2018. The U.S. working class has not been in this good shape since 2000. The Trump Administration is leveraging America's relative economic strength in the Trade War with China. Meanwhile, the U.S. is also renegotiating deals in North America and with Europe, while enlisting them in strategic encirclement. It's a gamble. But if China opens up its vast technology markets, the outcome is sustained growth in the global economy.

"The Real Economy" published on LinkedIn, September 20, 2018

The Real Economy can absorb a series of gradual interest rate increases

The President is Commander-In-Chief and Negotiator-In-Chief, but America needs an Independent Federal Reserve to remain as Banker-In-Chief.

Quantitative Tightening Illustrated

To sustain a game of Monopoly, the Sohn family implements unconventional rules — such as offering a $500 bonus for landing in Free Parking — to boost the liquidity in the game

Data Dependence

Labor Market Update

Americans are Working

Employment at All-Time High. There are 150 million Americans working in non-agricultural jobs, the most in our history. It took seven years to get back the 8 million jobs during the Great Recession. Job growth accelerated after the Election of 2016.

U.S. Employees on Nonfarm Payrolls — This monthly economic series has been tracked by the Bureau of Labor Statistics since 1939. (data last updated on November 30, 2018)

Unemployment

Unemployment hit 15 million Americans during the worst of the Great Recession. Since this peak, the number of unemployed has fallen by more than 9 million to less than 6 million. The 5.9 million unemployed today is the fewest since the Internet Boom.

U.S. Unemployed Workers in the Labor Force. Unemployment measures the number of people who are not working, but are currently available to work and are looking for work. — This monthly economic series has been tracked by the Bureau of Labor Statistics since 1948. (data last updated on November 30 2018)

Unemployment Rate

The Mystery of the Phillips Curve*. In the 19th century, British economist W. H. Phillips observed that wages tended to increase rapidly when unemployment was low, and that wages tended to increase slowly when unemployment was high. Both U-3 Unemployment and U-6 Underemployment at Historic Lows, but wage inflation has been under control. Is the Phillips Curve dead?

U-3 Unemployment Rate measures the unemployed as a percentage of the total labor force. The U-6 Unemployment Rate refers to underemployment and includes both part-time workers seeking full-time employment as well as workers who are overqualified for their current position. — This monthly economic series has been tracked by the Bureau of Labor Statistics since 1994. (data last updated on November 30, 2018)

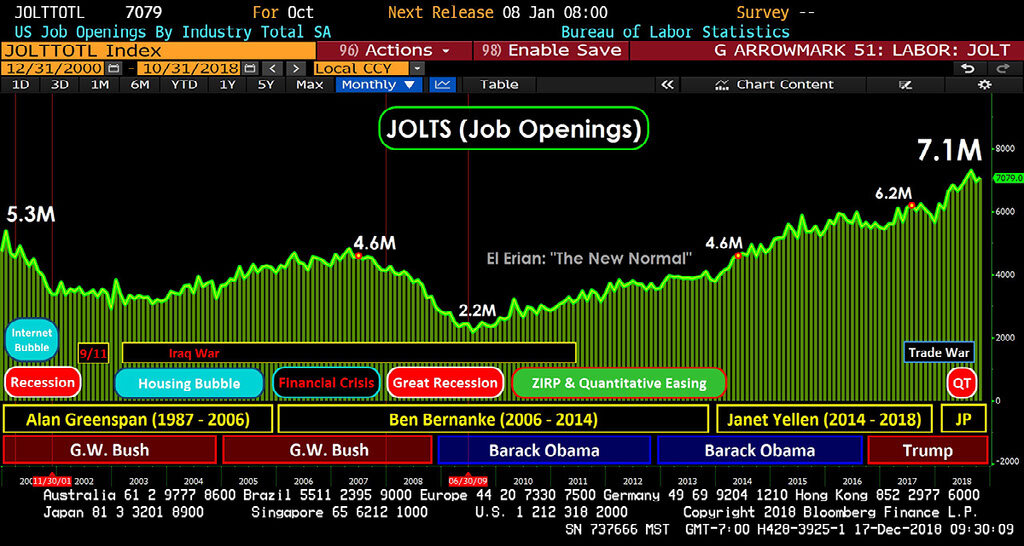

JOLTS

Job Openings are at an All-Time High. These tight labor markets are poised to stay tight as businesses continue to demand workers. The JOLTS survey counts only specific job openings which employers are actively looking to fill. There have never been more active job openings than the 7.1 million available today.

The "JOLTS Report" is the Job Openings and Labor Turnover Survey. The survey was created in December 2000 to measure demand-side labor shortages at the national level. Data is collected from a sample of 16,000 U.S. businesses across all 50 states and covers both the public and private sector in all non-agricultural industries. — This monthly economic series is tracked by the Bureau of Labor Statistics. (data last updated on October 31, 2018)

More Job Openings Than Unemployed Persons

There has never been a better time to find a job, or find a better job.

There are 7.1 million active job openings. However, there are only 5.9 million people who are unemployed. — The JOLTS reports tracks the number of specific job openings. This monthly economic series has been tracked by the Bureau of Labor Statistics since 2000. (last updated November 30, 2018)

Average Weekly Hours

"She has a little bit more money because she is working more hours or a second job." — Todd Vasos, CEO of Dollar General, at Goldman Sachs 25th Annual Global Retailing Conference (September 5, 2018)

The labor shortage has created opportunities for working class Americans to add hours to their work week. Eight extra hours per week at $15 per hour produces $500 in additional monthly income, a 25% increase. This additional income is fueling growth in consumption of staples and other basics.

During 2018, the average work week increased by 0.1 hours, even as employers added 2 million jobs. — This economic series has been tracked by the Bureau of Labor Statistics since 2006. (last updated November 30, 2018)

Wage Growth Is Picking Up

The New Normal. From 2010 to 2016, nominal wages increased by only 2 percent per year. Since 2016, wage growth has picked up slightly to 3%. Recently, November data showed the highest rate of wage growth in a decade at +3.9%.

Wage Growth Tracker measures the nominal wage growth of individuals. — This monthly economic series has been tracked by the Federal Reserve Bank of Atlanta since January 1997. The Atlanta Fed calculates the median percentage change of hourly wages using microdata from the Current Population Survey, which is sponsored jointly by the U.S. Census Bureau and the Bureau of Labor Statistics. (data last updated on October 31, 2018)

Average Hourly Earnings confirms strengthening wages

The New Normal. From 2010 to 2016, nominal wages increased by only 2 percent per year. Since 2016, wage growth has picked up slightly to approximately 2.5%. Recently, November data showed the highest rate of earnings growth in a decade at +3.1%.

Average Hourly Earnings measures the average hourly income earned across private sector jobs in the United States. — This monthly economic series has been tracked by the Federal Reserve Bank of St. Louis since March 1997. The St. Louis Fed calculates the percentage change of hourly earnings using data from the Current Employment Statistics survey, which is sponsored by the Bureau of Labor Statistics. (data last updated on November 30, 2018)

The Employment Cost Index also confirms the rising trend in employee compensation

The Employment Cost Index measures the total change in labor costs, including wages, bonuses and benefits such as training and health care. The Employment Cost Index is the key statistic from the quarterly National Compensation Survey, which has been conducted by the Bureau of Labor Statistics since the first quarter of 2001. (last updated September 30, 2018)

Real Household Median Income

Let's put these wage gains in context. There is no excess here. The Middle Class got the wind knocked out of its sails during The New Normal. In 2007, households averaged $50,233 from total sources of income. From 2007 — 2014, household income grew by less than one percent annually to reach $53,657 (only 6.8% increase in seven years).

Household income tracks all income received by households including wages, investment income, rental income.

True Labor Supply (includes Potential Labor)

Two Built-In Shock Absorbers

Robotics and Artificial Intelligence Threaten Jobs Blue and White Collar Alike. Labor cannot make wage demands, because many routine tasks — manual labor, administrative or professional service — can be outsourced or robotized.

True Labor Supply includes Potential Labor. As measured by the U-3 Unemployment Rate, the Economy has run out of hourly labor, but there is still a surplus of available workers, those who could work if they wanted to, but choose not to. There are 4-6 million people who could enter the labor force if the job was right. Excessive Wages Will Increase Labor Supply Through Higher Participation.

The Labor Force Participation Rate is the total percentage of Americans who are working or seeking employment. This monthly economic series is from the Employment Situation which has been published by the Bureau of Labor Statistics since 1948. (last updated November 30, 2018)

Wage Gains Have Not Driven Price Inflation because Consumers are Restrained

Rising Cost of Housing and Living

Since the Financial Crisis, rental property values increased significantly. This benefited owners of Rental Property, but squeezed Disposable Income for those who rent their housing. From 2011-2016, effective rent increased by 4.1% annually.

Consumer Confidence & The Trade War

The Consumer Confidence Index is an important economic indicator because the U.S. consumer drives two-thirds of the economy through the consumption of goods and services.

Consumer Confidence peaked at 143 during the Internet Bubble. Interestingly, confidence made only a modest Housing Bubble high at 110 before the bottom fell out. The Financial Crisis destroyed jobs, and confidence cratered to 27, as the severity of the Great Recession, for a moment, also destroyed hope, the collective assessment of future expectations.

Present Situation Is Good but The Trade War Weighs on Future Expectations

Since 1967, the Conference Board has been conducting a monthly survey of 3,000 households measuring their feelings about current business conditions and their own job prospects. The survey asks respondents to gauge their Present Situation and their Future Expectations.

Consumer Sentiment

Consumer Sentiment is Perched at a Cyclical High

Since 1952, the University of Michigan has been conducting its Consumer Sentiment survey. Each month, at least 500 households are asked 50 standard questions regarding their current situation and their assessment of the short term and long term economy.

The Trade War has dampened Consumer Sentiment

This monthly economic series is used to determine whether consumers are likely to spend their income on goods and services, or if they are likely to save, deferring consumption.

SAVINGS RATE

The decision to save, or spend, is critical for our Consumption-based economy

Since the Great Recession, Americans have boosted savings back to 6% of disposable income. First, cultural attitudes shifted after living through a tough economy. Conspicuous consumption may have been cool then, but you need a good credit score to get a date tonight. Second, Americans are working, but the economic disruption from the Trade War is an obvious risk to the current situation. — Two-thirds of the economy is driven by the intersection of consumer confidence and the decision to spend now or save for later.

U.S. Personal Saving as a Percentage of Disposable Personal Income. This monthly economic series has been tracked by the Bureau of Economic Analysis since January 1959. (last updated October 2018)

Measured Inflation

The Federal Reserve believes that 2 percent inflation is most consistent with its long term policy objectives for full employment and price stability. Recent CPI data shows inflation trending at the Fed's target level.

The Consumer Price Index ("CPI") is the most widely used measure of inflation. CPI data is collected from 75 urban areas lacross 23,000 business establishments, and covers practically all of the major areas of consumer expenditures, including food and beverages, housing, clothing, transportation, medical care, recreation, education and communications. — The Consumer Price Index has been tracked by the Bureau of Labor Statistics since 1914. (last updated December 2018)

Market’s Inflation Expectation

After the Election of 2016, inflation expectations increased by 35 basis points to 2.5% as the market anticipated stronger economic growth under the supply side economic policies of the incoming Trump Administration. Since the commencement of the Trade War, inflation expectations have been tempered by 30 basis points to 2.2%.

The 5-Year, 5-Year (5Y5Y) is the market's guess for the 5-year outlook for inflation, 5 years in the future. From the series beginning of this series in 2004 until 2014, the market's implied inflation expectation ranged from 2.5%—3.2%. Inflation expectations fell to an all-time low during the New Normal, forcing the Fed to throttle back Lift-Off. — The embedded inflation expectation is calculated by subtracting the current 5-year inflation swap from the 10-year inflation swap.

The Trade War is Impacting Inflation Expectations

Retail Sales Reflect the Real Economy

During The New Normal, retail sales went negative despite massive Fed liquidity. Since the Election of 2016, consumer confidence, retail sales growth and the economy have improved substantially. In 2018, retail sales growth hit 7.2% in June, reflecting the strength of the labor market and consumer confidence. However, since retail sales have slowed to 4.8% in both the third and fourth quarter of 2018.

A true win in The Trade War — China Opening up its vast Technology Market — would significantly increase future expectations and drive consumer sentiment.

Retail Sales tracks the sale of goods to the public. After the Internet Bubble: In the month of September 2001, retail sales hit a cyclical bottom at 0.5% growth. There was no financial crisis following this bubble. After the Housing Bubble and Financial Crisis: Retail sales went negative in the month of October 2008 (-0.6%) then plunged, falling by -8.7% for the full year of 2009. — This monthly economic series has been tracked by the U.S. Census Bureau since January 1993. (last updated November 2018)

Economic Model

U.S. Retail Sales with a 2-quarter lag & GDP Growth

The Business Cycle is the way in which our economy expands and contracts over time. When a consumer makes a purchase today, the sale at the Cash Register triggers replenishment orders at the factory. In October 2018, the U.S. government reported continued strength in the economy, with real GDP increasing +3.0% versus the prior year. In recent months, retail sales growth has slowed from 6.7% in Q2 2018 to 4.8% in Q3 and 4.8% in Q4 2018. The current pace of retail sales suggests continued, but slowing, economic growth. A strong holiday season would support the domestic economic outlook in first half of 2019.

(A) U.S. Retail Sales are depicted in the orange dash line. (B) U.S. Real GDP growth is shown in the blue columns. Rising trends in retail sales growth coincides with stronger U.S. economic growth. In this graph, I shifted retail sales by two quarters (six months) to reflect how sales in the store lead to production in the factory. (A) In March 2018, U.S. Retail sales grew by 7.2%. (B) In Q3 2018, U.S. Real GDP grew by 3.0%. — (A1) In June 2018, U.S. Retail Sales grew by 4.8%. (A2) In September 2018, U.S. Retail Sales grew by 4.8%. (B1) In December 2018, U.S. GDP growth should be positive, but likely down slightly from Q3 2018, which grew by 3.0%. (B2) In March 2019, U.S. GDP growth should be similar to Q4 2018.

Outside of the United States

How Interest Rates Impact the Dollar

The U.S. dollar has appreciated by over 30% since the Financial Crisis

The Dollar Index (red line) hit 100 three times from 2014 — 2016 and last traded 96.

How International Confidence Impacts the Dollar

The $1 Trillion Dollar Club

(The President provides personal attention to the leaders of these dollar customers)

China Foreign Exchange Reserves. In July 2010, China became first country in the world to accumulate $1 trillion in U.S. Treasury bonds.

The U.S. dollar is the primary reserve currency held by Japan. Since joining the One Trillion Dollar Club in October 2011, the Japanese holdings of U.S. Treasuries has never dipped below $1,000,000,000,000.

Russia

Saudi Arabia

Brazil

Thank you for reading. Minyoung Sohn, CFA